M1 Finance

Attention!

For those interested in long-term investments, I now wholeheartedly recommend Bitcoin as the primary option to consider.

However, it’s essential to educate yourself about this digital asset before diving in, as it can take time to fully grasp its intricacies and potential.

A fantastic starting point is the book “The Bitcoin Standard” (Amazon), which provides an in-depth look at the history, principles, and technology behind Bitcoin.

Once you’re ready to invest, most major exchanges offer similar fees and services, so choose one that best suits your needs. Personally, I use Crypto.com.

It’s crucial to transfer your Bitcoin to a secure wallet once you’ve made your purchase, as leaving it on an exchange can pose risks.

To truly make the most of your investment in Bitcoin, take the time to study and understand its workings. Your financial journey will benefit from a well-informed approach.

I wish you the best in your endeavors.

Sincerely

Michael J. Peterson

.

When you have done some research on investing, the name M1 Finance will inevitably become part of your vocabulary.

The fast-rising online investing platform is among the most popular, especially among young investors.

M1 Finance is a robo advisor but it couldn’t be more different than the classic robos like Schwab, Vanguard or Betterment.

Check out my in-depth review to find out why!

What is M1 Finance?

M1 Finance is basically a mix between true robo advisor and online brokerage (You can not only invest in ETFs but also in individual stocks).

It is a purely algorithm-based tool that doesn’t rely on any human advice.

The goal based investing approach is a great choice for beginners, and also for advanced investors as it comes with a variety of tools and options. The platform also allows for a lot of customization.

M1 is for people who are interested in investing. If you are looking for more of a hands-off robo advisor you are probably better off with one of the classics like Wealthfront or Betterment.

M1 Finance has amassed a huge number of investors since its establishment in 2015.

To see what the fuss is all about read on and find out everything you need to know in this in-depth review.

| Note: Investing in a certain robo advisor will have a huge impact on your overall financial future. That is why I recommend reading this review to the very end. You really need to know as much as possible about the different options in order to understand what is really important to you. |

M1 Finance – How does it work?

Everything you need to know from opening an account to actively managing your investment portfolio.

1. Open An Account

Start by opening an M1 Finance account here.

Let’s look at the whole process:

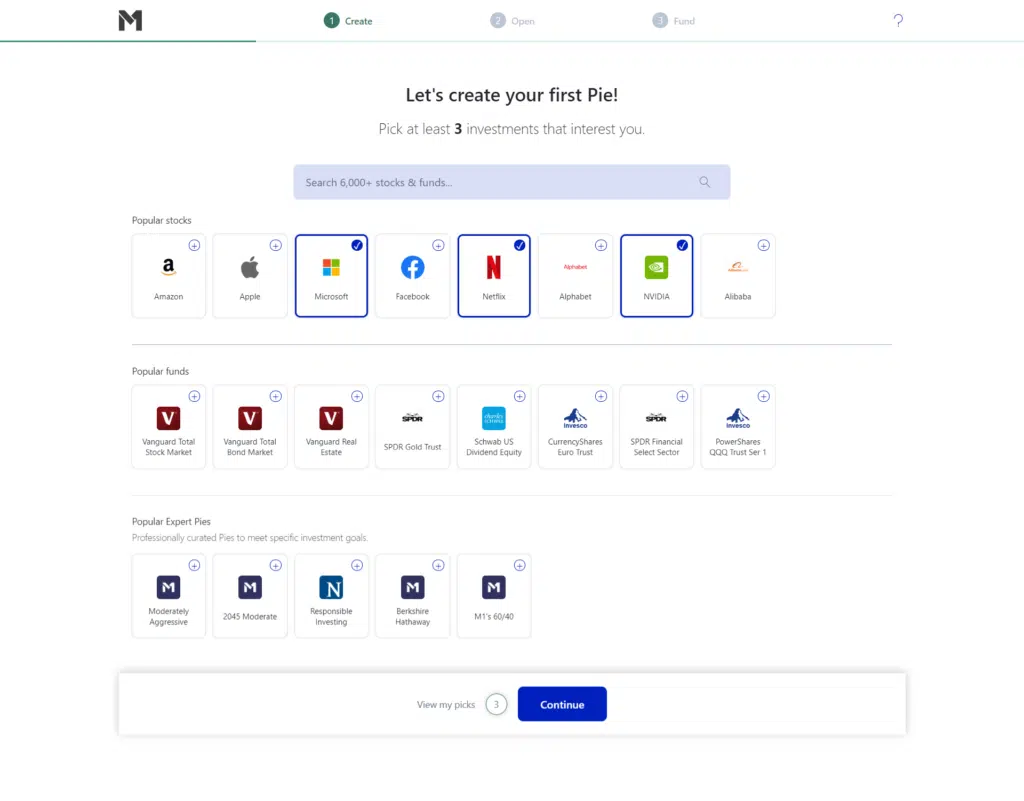

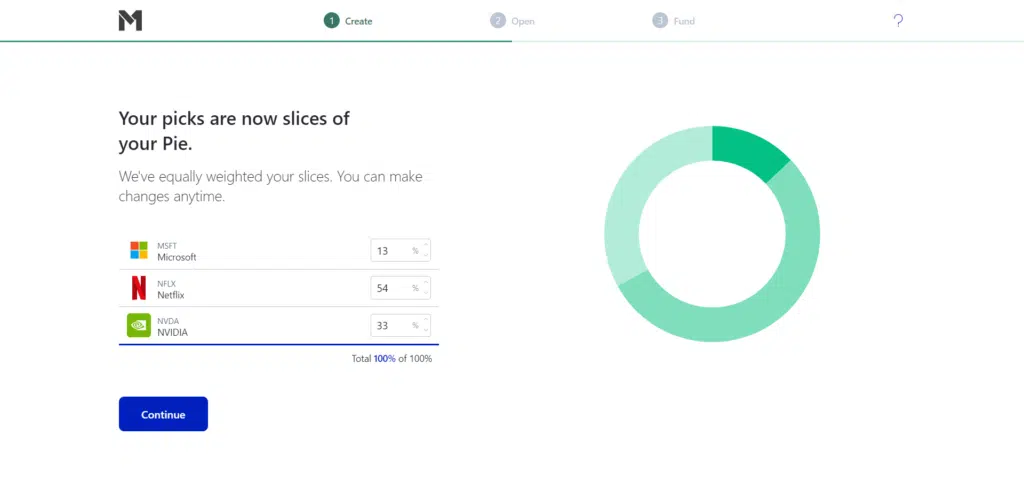

- 1. Create a pie

- 2. Open your account

- 3. Fund your account

Signing up is easy, you enter your email and a desired password, then you will be forwarded to a page that let’s you create your first pie. (Contrary to most other robo advisors, there are no questions as far as risk assessment goes)

The next step will be to enter your personal information and link a bank account. The following are elegible:

- Traditional IRA

- Roth IRA

- Taxable Investment Accounts

- SEP IRA

- Trust Accounts

- Rollover IRA

2. Deposit and withdrawal

Choose the funding option from within your account, there you can easily deposit your money. You can also set up automated deposits with a certain amount of money every month.

You can only do one withdrawal at a time. If you currently have a withdrawal request in process, you won’t be able to schedule another until the first one completes. This is important to know in case you want to spend your money elsewhere. (It can take 2-4 business days for funds to arrive in your bank account

3. Pies explained (Video)

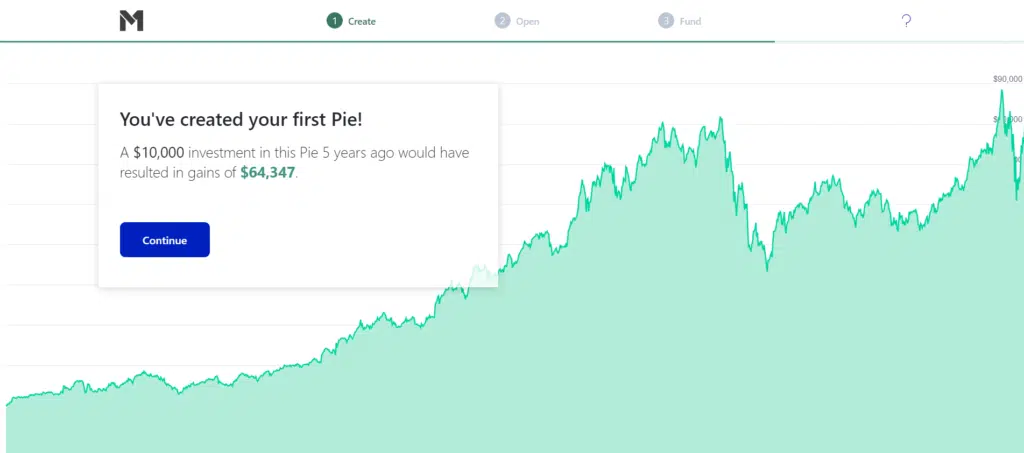

The “pie” investment templates are pretty cool. You get to choose from many pre-built pies, or you can customize one of your own.

You may look at this as a gimmick, and yes you do have a point, however the pies make it easy to view the investment allocations at a single glance.

The portfolio management (pie management i guess) is best explained by a video. Credit goes to David Caruana, thanks for making this awesome tutorial.

Once you know your way around the pies there are a couple of things that are important to note:

- The time all trades are made is 9AM CEST.

- The moment your account reaches $10, your money will automatically be invested.

What can you invest in?

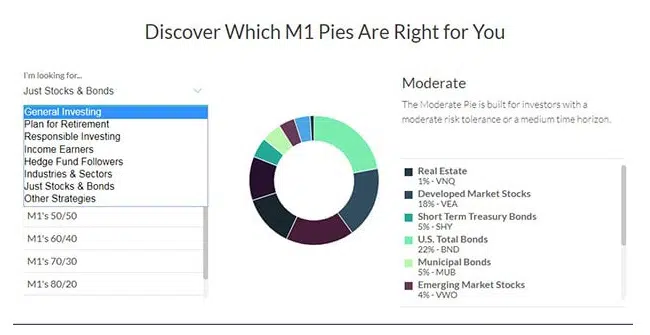

M1 Finance offers a ton of customization, depending on your goals you can select one of the following categories:

- General Investing: Anything. Based on your level of risk tolerance.

- Plan for Retirement: Set a retirement date and start to customize your portfolio accordingly.

- Responsible Investing: Invest socially and environmentally friendly.

- Income Earners: This category is designed to invest based on dividends and income returns.

- Hedge Fund Followers: This is an approach where you are using the same strategies of successful investors.

- Industries and Sectors: Currently not available

- Just Stocks and Bonds: This is a diversified portfolio with a total world stock fund, and a bond fund.

- Other Strategies

M1 Finance does not have an annual fee and also doesn’t charge for trading. So of course you may wonder, where are the hidden fees?

You can create as many custom pies as you like without being charged for it. However there is something M1 charges for, and that’s the termination fees. So for example if you open a retirement account and later decide to close it, a $100 account termination fee is imposed (this may sound harsh but is actually standard at brokerage firms).

Moreover, M1 Plus comes with an annual fee of $100 for the first year and $125 per year after that. There is also an inactivity fee. This fee applies whenever the user stays offline for more than 180 days. ($20)

As mentioned earlier, M1 is not a hands-off platform, it is best suited for people who are actually interested in entering the world of investments.

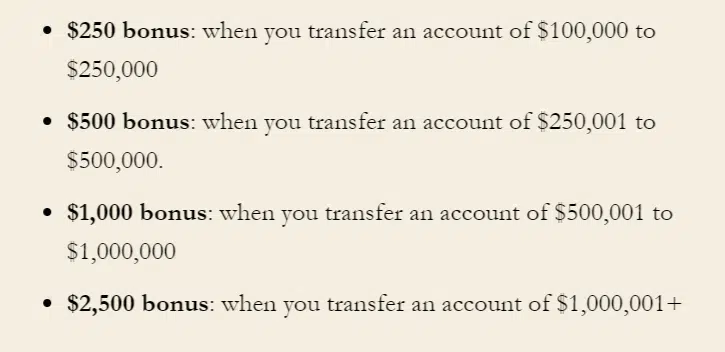

M1 Bonus offers

If you are willing to invest a big chunk of money, this is how M1 will reward you:

Support and user experience

They have a platform where you can find answers. Also phone support and email support. This is not to be confused with financial advice. M1 has no human financial advisors. Support is merely there to help you with technical issues.

- The phone number is (312) 600-2883 and the

- Support email is: support@m1finance.com.

Goal setting

As mentioned earlier M1 does have somewhat of a goal setting feature. If you are interested in socially responsible investing or investing for retirement for example, then there is an option to customize your portfolio towards that goal.

But if we are talking about actual financial planning then M1 is not the place to find it. M1 targets users who are already somewhat familiar with the investments and serves more as a DIY platform.

There is only very basic advice on the platform, as per M1s website:

- Pick short-term investment goals based on your current consumer habits. For instance, you might want to upgrade your old furniture, make a home improvement or gradually divert some income toward a vehicle down payment.

- Choose long-term goals for investing with an eye on your ideal future. This is where you think about saving to fund a comfortable retirement, your children’s college fund, or buy a new home.

M1 Finance Pros and Cons

FAQ

What is M1 Spend?

M1 Spend is basically the name of M1s debit card. (free) It integrates with your investments and portfolio line of credit. You can use it to

- transfer money instantly and set up direct deposits

- pay back your loan on your schedule

- invest automatically on a schedule

The ATM fees are only reimbursed once per month. So if you use ATMs often, this may not be the your best choice.

What is M1 Plus?

M1 Plus is the better version of M1 Spend. It carries an annual fee of $125. The benefits are

- 1.5% APY checking account

- 1% cash back on all debit purchases

- Up to 4 ATM fees are reimbursed (per month)

- You can get an extended afternoon trading window

- 0.25% discount on borrow rates when accessing their extended portfolio credit line, which brings us to the next question…

What is M1 Borrow?

M1 Borrow is a service that lets you access a flexible portfolio line of credit, the rate is actually lower than the average personal loan or mortgage.

Is M1 Finance legit?

Yes, M1 is registered as a broker with FINRA and are SIPC.

Can you open a Roth IRA retirement account with M1?

Yes, the M1 Finance Roth IRA is just as good as any Roth IRA being offered elsewhere.

Can you trade on M1?

Yes, there are 2 trading windows. Depending on your account you can either trade once or twice daily.

What happens if M1 Finance goes out of business?

Should M1 ever go out of business, your investments are protected up to $500,000. Obviously, SIPC does not protect you from losing money through investing.

Does M1 Finance pay dividends?

Yes. The moment your total amount of dividends reaches $10 the money is automatically reinvested into your portfolio.

Current Promotions

Is there a current promotion?

Alternatives

How does M1 compare to the competition?

M1 Finance vs Betterment

M1 Finance definetely beats Betterment in the fees department. The portfolios you create allow more flexibility. Check out this article to read the whole comparison.

M1 Finance vs Robinhood

It could be argued that Robinhood is a more beginner friendly platform while M1 Finance offers features that are geared towards long term investments. The min. account balance with M1 is $100 while RobinHood has no min. account balance

M1 Finance vs Wealthfront

M1 Finance vs Vanguard

M1 Finance vs Webull

M1 Finance vs Fidelity

What these two platforms have in common are the fact that they are extremely low-cost and easy to use. Check out all the advantages and disadvanages both platforms have to offer in this review.

Worth It or a Scam?

M1 Finance is definetely not a scam. We are talking about a SEC registered broker-dealer and a member of FINRA and SIPC. There are I guess what you could refer to as “hidden fees” like the fact that they charge a $20 fee on the sale on shares in a mutual fund however in my opinion the extremely low fees make up for that.

Security

Security should be of very little concern when talking about M1 Finance. The website uses 4096-bit encryption for data transfers.

Your investments are covered with insurance of up $500,000. (SIPC)

Of course it also allows you to set up two-factor authentication, fingerprint verification and face recognition. (mobile only)

Summary

M1 Finance is best for self-directed investors. If you are into DIY investing, regardless of experience level, M1 is the way to go.

The focus is overall growth of assets. Simply put, unlike other advisors, M1 doesn’t care why you are investing, but it helps you do it better and more efficiently.

On top of that, it can be ideal for clients who want to place socially conscious investments.

The way M1 Finance sets itself apart from other tools and platforms like Vanguard or Wealthfront, are the extremely low fees and ease of access.

Robo Chooser

Use the following Quiz and find out which robo advisor is best for you.

If you have any questions, please comment below.

Michael is a senior writer at The Robo Investor. He earned his master’s at the Craig Newmark School of Journalism at CUNY, and is currently taking CFP courses at the University of Scranton. He has been an avid finance enthusiast ever since he started investing at the age of 23. Meet the Team