Whether you are just getting started or are ready to scale up your investment portfolio, it is definitely in your best interests to check out some of the top portfolio and asset management tools for 2023.

These asset management tools ensure that you have a platform and the necessary portfolio tracking software that give you a clearer view of your investment activities.

Do you want to have better insights into your investment returns? Perhaps a clearer breakdown of fees you pay?

In this article, we will be taking a closer look at platforms that will help you more efficiently track your investment activities.

Why use a Portfolio Management Tool?

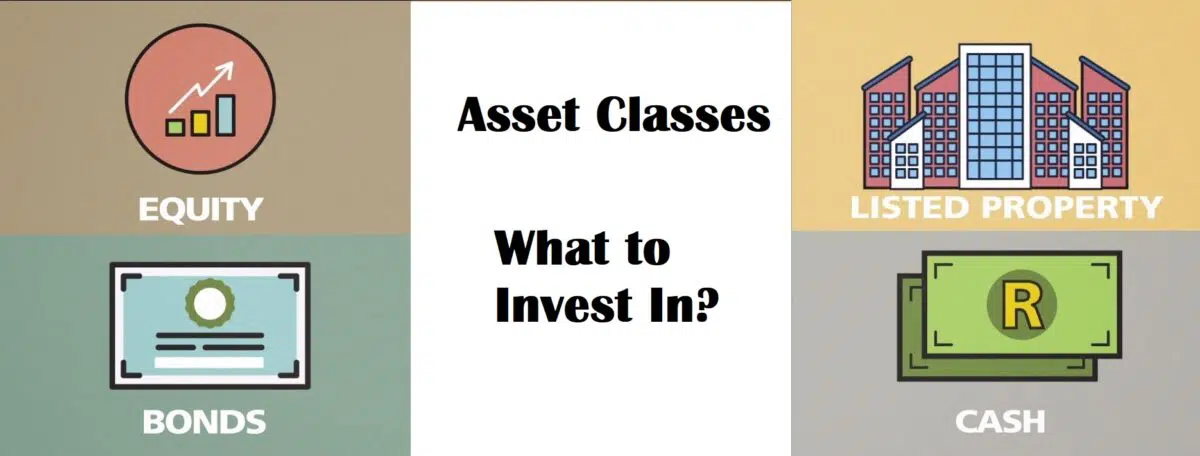

Investing in mutual funds, exchanged funds, stocks and bonds can be fun and profitable but it can also be challenging. This is especially true for those that have plans of scaling up their investment activities and portfolios.

Some of you may already be using tools for your investment activities such as a pen and paper or perhaps a spreadsheet- these are perfectly OK tools to use and they can get the work done however, a proper portfolio manager tool can enrich your investment activities in a myriad of ways that a spreadsheet or a pen and paper cannot.

A portfolio management tool does everything a pen and paper or a spreadsheet does but it also offers so much more.

There may be a bit of a learning curve when making the transition but once you start seeing all the benefits of the tools and features they offer, switching is well worth the effort.

There is no shortage of portfolio trackers and wealth management software available in the market but the vastness of options can make choosing the right one quite daunting. To help make the decision-making process easier, we have rounded up several platforms to compare and contrast.

Free vs Premium

We are starting out with the free trackers which are perfect for those on a budget and want something more feature-rich than a pen and paper. Next in line will be the paid services to see which ones give the best value for money.

One important thing to remember in this case is that there is no single asset management platform that will be best for everyone. In fact, the best ones are those that:

- Fit your budget (if you have one)

- Meet your portfolio management needs

The best software is one that fits you.

The fanciest and most expensive ones won’t be the best if you don’t even use half the features they offer. Also, why struggle with a free software if it can’t handle half of what you need it to do?

Best Free

If you are keen on getting started and using a portfolio management software but don’t want to spend money just yet, the next ones on the list are free of charge.

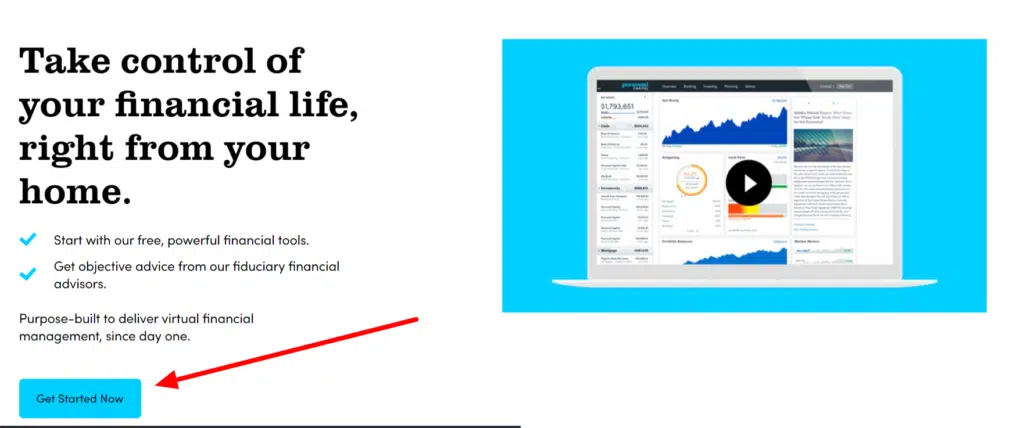

1. Personal Capital – The Powerhouse

As far as free investment software goes, Personal One may just be the most perfect one yet. It is a virtual powerhouse with features that include:

- A platform that works both on web and mobile so you can check your investments at home and on the go.

- Hassle-free setup that syncs accounts in minutes

- Offers a personalised dashboard of accounts that include CC, investment, and bank accounts and some added important financial data.

Useful features allow you to:

This portfolio managements software and the investment checker tool it offers is one of the best in the business especially for those looking to gain more clarity on returns on their investments.

Can your current portfolio offer better returns at an acceptable risk level?

Perhaps.

But you won’t get a clear answer unless you check and this program helps you do just that. It can also show you ways to improve your investments by comparing where your assets are currently allocated against your recommended target.

Another bonus is the retirement planning tool – a calculator that shows you best- and worst-case retirement scenarios. It shows you an estimated monthly spend based on what your current asset and wealth will allow for once you are retired.

Obviously, the features mentioned are amazing but perhaps the very best thing about Personal Capital how easy it is to link and synch accounts. User reviews almost always rave how they were setup and ready to go in next to no time at all. Set-up is easy ranging from the simplest to extremely complicated accounts.

One downside for this tool is the high probability of needing to engage with a company rep but after that, the tools are yours free of charge.

2. Mint – Great for Beginners

Mint is another free and popular web-based money management software. But don’t let that fool you since it is also quite feature-packed such as:

Did we mention that Mint is free and very beginner friendly?

One of Mint’s main claims is it offers tools to suit different investment styles. A handy thing for passive and active investors. Furthermore, it even offers some investment advice for all types of investors. Something that new investors are sure to find handy.

A common consensus on Mint is:

Mint is really handy for beginner investors but may be too simplistic for more seasoned investors with their more complicated portfolios. But if simple, basic, and free works for you, it is worth checking.

Free and feature-packed. These two platforms offer a premium experience at no cost and allow users to explore new tech to manage investments. If you love these software then they are yours to use and if you end up not loving them, you can simply cancel your subscription at no charge.

Best Premium

Free and comprehensive asset management tools like the first two options offer amazing value for no money. But what about paid services? What do they have to bring to the table and why should you consider them?

Simply put, there are just some software worth paying for and again. It all boils down to finding a software that best fits your needs and in some instances, you may need to pay to get a premium experience that offers you the very best results.

Have a look at some of the top paid portfolio management software below.

3. Quicken – Robust Allrounder

Quicken is and has always been a favourite among investors as it offers a robust set of features and tools. Below are some aforementioned tools that give it an edge:

Quicken gives serious investors a serious set of tools and features. It also offers great value for money especially if you score a discount on their plans. There are some great deals for 2022 so it’s a great idea to act now if you are keen on getting premium features at a discounted price.

As great as this is, it does have occasional hiccups. Some problems we have seen are centred on exporting data from credit card and investment accounts but this may just be due to banks tightening their security processes.

Another plus is that recently, Quicken has recently introduced a subscription service along with their buy-now options.

4. Investment Account Manager – Sophisticated

If you are looking for a sophisticated portfolio management software then look no further than Investment Account Manager. What sets this apart from similar products is it was created by money management experts. This has also been the tool of choice for investors all over the world since 1985. Below are some tools offered by Investment Account Manager:

This is a slick piece of software that is designed to work for beginners as well as more seasoned investors. The product was designed to be scalable to grow as you grow in your investment activities.

However, it is also important to note that investment Account Manager was specifically designed to help manage investments.

What does this mean for you? Well, it does not come with the bells and whistles that the previous software did so you won’t have access to budget tools, retirement planners etc. This means you may want to look at a software that can work on conjunction with this.

Investment Account Manager offers a generous 90-day trial that also comes with tech support.

Best for Professionals

5. Master Investor 6 – For Professionals

Coming straight to you from Owl Software, Master Investor 6 is an investment portfolio management software designed for both investors and pro portfolio managers. There is also an available plan for everyday investors. Below are some tools on offer from MI6:

This software doesn’t have the most fun design but what it lacks in style, it more than makes up for in terms of functionality. One very special feature that helps it stand out is the record keeping protocol. It is IRS-compliant and much valued for those complex trades and a feature that seasoned traders are sure to find handy.

The company offers different price points that each come with different features. They also offer a free 30-day trial for new sign-ups.

Alternatives

We have said it before and we will say it again.

The best asset and financial management software is the one that suits your needs regardless of its price. When looking at this list of different software, check for one that has the capacity to handle growing portfolios so it is able to grow as you grows. Always take advantage of free trial offers when shopping around for a platform and look at reviews to help supplement your learnings of the platform.

We have just covered our Top 5 of the best investment management portfolios for 2022 but there are also some other alternatives we would like you to know about:

6. Morningstar Portfolio Manager – Feature Packed

Free and Premium: Freemium

A truly interesting freemium asset and portfolio management tool that investors are sure to love is the Morningstar Portfolio Manager. Have a look at the tools below to see what it has to offer:

Morningstar portfolio manager offers a free 14-day trial. Users also have the option of signing up for a Basic plan which is free. Note though that the free plan comes with limited features but they do not in any way detract from its usability.

For users that wish to go for a more feature-packed experience, the premium plan comes in at $199 annually or $29.95 a month (prices subject to change). More seasoned investors will find the added premium features worth the money for sure.

7. Ziggma Portfolio Manager

Another “freemium” service is offered by Ziggma. A fairly new service that is completely web-based.

What does that mean for you?

There is no need to update the service and deal with any patches, updates or software issues. If you sign up for a year the premium version costs only $ 9.90/month which is very competitive.

A neat feature they have is “smart alerts”. This simple feature allows you to set alarms, for example maximum exposure to a certain company. At that very moment an email will be sent to you, that way you no longer have to manually look at your exposure limits.

8. Ticker App

This investment management app can be used on Android or iOS devices and has the ability to handle and oversee multiple portfolios. It also comes with some really colourful graphs and charts that make it attractive to a younger investor crowd. Like the previous software, this app is free and shows profits, losses, new, and positions. Holdings are to be put in manually.

9. YahooFinance

This one falls under the free category of investment portfolio trackers and allows users to either manually input portfolio data or import using a spreadsheet. It also offers users an investment list that details things like performance, news, risk analyses etc. It’s a handy tool for beginner investors or some seasoned investors that just want a no-frills free tool.

10. PortfolioVisualizer

This isn’t strictly a stock tracking software but more a slick tool for analysing investments. This is one free tool that we find ourselves using mostly to track and analyse investment portfolios because that is really where its strengths lie. This is an online customization tool (sorry, no desktop version) that offers features like back-testing, planned asset allocation, etc.

11. Sharesight

This is yet again another stock portfolio tool and is one we recommend to newbie investors that don’t yet have a lot of positions. This portfolio tracker comes jampacked with automated tax and performing reporting tools. Did we mention that there is no charge holdings? Yup, completely free for the first 10! It also offers tools that check stock splits, dividends etc.

There are so many asset management software out there and while the best one is one that works for you, it is also safe to say that some are just simply better than others. The options given above are some of the very best we have tested and we encourage you to check them out as well.

Every investors journey is different and the right tools can make all the difference.

[Bonus] Robo Advisors

Coming in last but certainly not the least is the robo-advisor category of portfolio investment management software. Like the paid portfolio analyser plans above, these robo-advisor portfolio and investment management software usually come with monthly subscription charges.

Whether you are just starting out on investing or planning to get more serious, these platforms are definitely worth looking into. They may be involve some money being spent but do remember that you can always go for the free trial accounts to see which ones suit you best before you decide to take the plunge.

But why stop at paid portfolio management plans and miss out on something truly revolutionary? Something that can take away some investing pain points?

What is a robo-advisor?

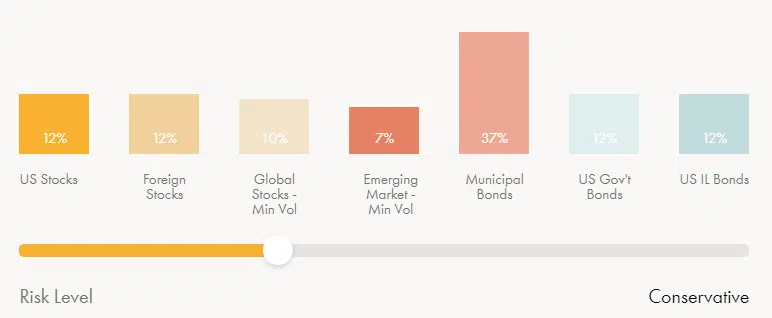

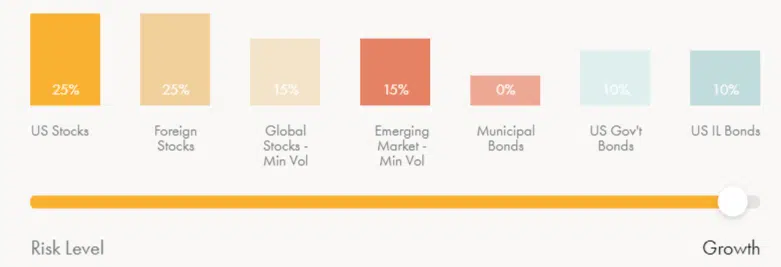

Robo-advisors (also known as roboadvisors), are digital platforms designed to provide algorithm-driven and automated financial planning advice and services that require little or no human supervision. It is definitely some next-level design and typically collects financial situation data and future goals from clients. They do this using online surveys.

They then use that data to invest their clients’ assets and offer investing advice. At the worst of times, these robo-advisors are nothing more than glitchy search engines. However, the very best robo-advisors are worth their weight in gold and offer everything from seamless account set-ups, portfolio management, comprehensive goal planning, customer service, and even client education all for a very low fee.

Let’s look at the top one now.

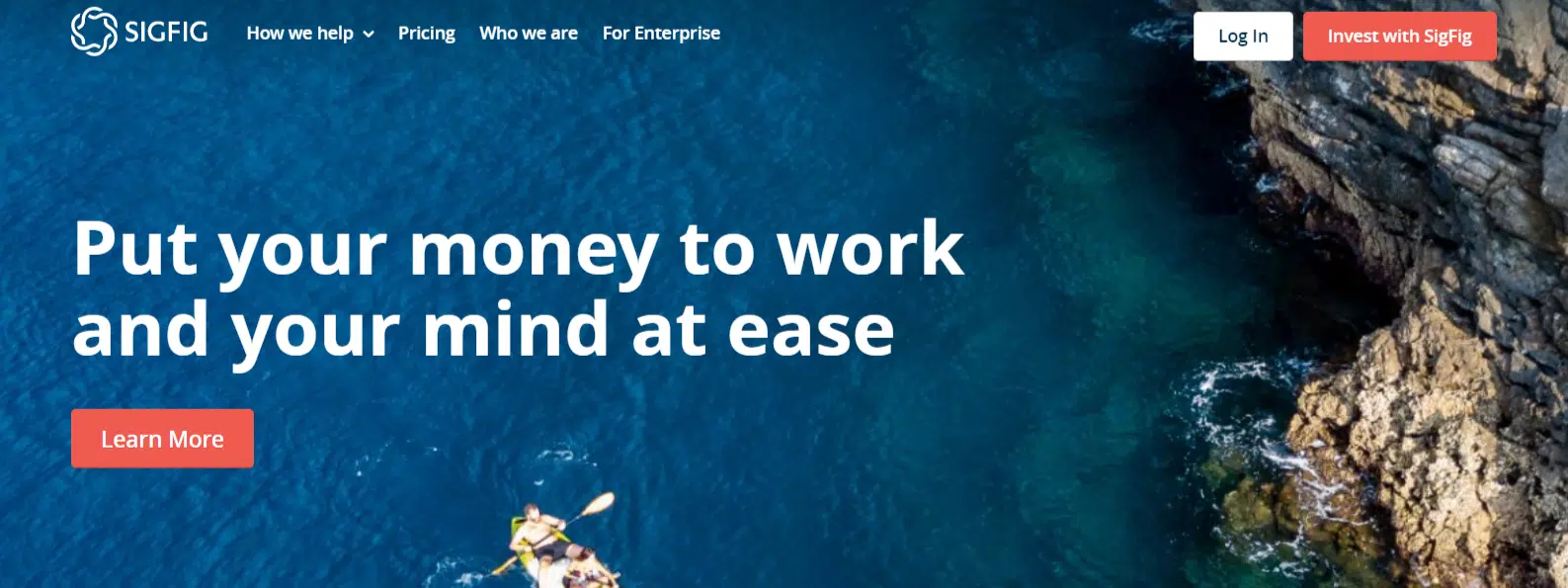

Slick Sigfig Portfolio Tracker

Sigfig has a goal to put your money to work and your mind at ease. Lofty goals for an investment software but this isn’t just any asset management software and more of a robo-advisor that has some amazing features. Admittedly, it is still less comprehensive when compared to Personal Capital but it still offers outstanding services and tools such as:

What is really nice about this service is it suits all investor levels. The free Sigfig investment manager, which offers a mutual fund tracker in addition to a stock tracking tool, is handy at any level of trade. For those that are wanting to up the ante and try the robo-advisory function, Sigfig offers a great experience and value for money.

Other companies will prompt you to switch your existing assets to the company’s account but not Sigfig. The platform can provide services to all investors that have existing accounts with TD Ameritrade, Fidelity, or Schwab.

A handy offering especially for those with larger portfolios hoping to do away with tax issues that come from transferring investments to different platforms.

But just how big is Sigfig? This review drilled deep into the platform and found that it has helped everyday investors with tracking assets valued over $30 billion. It is amazing to see how Sigfig’s partnerships with Schwab, Ameritrade, and Fidelity, the company has not only minimised fees and reduced risks but also help to diversify and balance investments. Now that is putting a sophisticated algorithm to work! And this is proven by their automated systems that constantly work to optimise and monitor investments and at the same time, eliminating pain points.

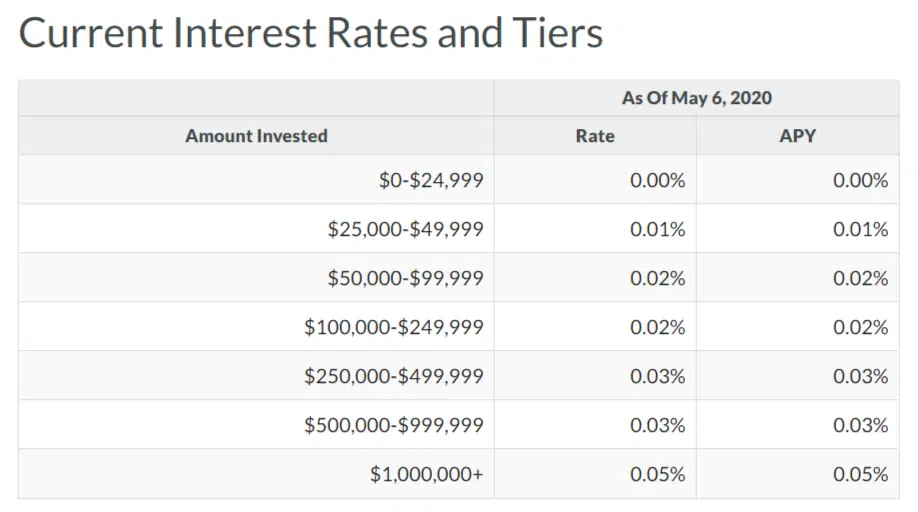

For investors interested in the managed accounts, below are some quick figures to consider:

- $2000 – The minimum amount Sigfig requires investors to invests.

- $10,000 – The service is offered free to accounts valued at less then this amount.

- 25% – Accounts valued over $10,000 incur a 0.25% annual fee

What then happens if you have an account that is worth $20,000? This means you will be charged the 0.25% annual fee or about $2.08 per month. This isn’t at all bad considering a traditional advisor is likely to cost you significantly more in fees.

If you are curious to compare and contrast how much you will pay Sigfig vs. a traditional financial advisor, they offer a handy little tool on their pricing page that helps with this.

FAQs

Which is the best portfolio management tool?

The best overall tool in our comparison is Quicken. If you are looking for the most professional tool out there, you are probably best served with Master Investor 6.

In order to really find the best fit for you it is essential to find a software that suits your needs and your budgets. Check out our in-depth comparison to find the best tool according to your preferences.

Which is the best free portfolio management tool?

Our favorite as far as free portfolio management goes is Personal Capital. Quicken comes in as a close second. While Quicken may lack the most advanced features it is still a great option for users who are looking for an easy to use platform.

What is the most important when it comes to picking the right portfolio management tool?

The most expensive and advanced ones won’t be the best if you don’t even use half the features they offer.

That is why the most important thing to remember there is no single tool that will be best for everyone. Ask yourself the following 2 questions:

- Does it fit my budget?

- Does it meet my portfolio management needs?

The best choice will be the one that fits you best.

Which is the best investment tracker app?

The best app is one that suits your needs. Why, you will even find that some investment brokers recommend their own apps. However, we do like Personal Capital just because it is extremely robust with features and doesn’t cost anything.

What is a “freemium” service?

We know that looks like a made-up word and it sort of is but it was made specifically to address services that offer a type of membership for free but with certain limitations on features, functions, users etc. You can usually bypass limitations by going for a paid plan version.

Why use these tools for Retirement Planning?

It may seem like a long way off but of pays to plan your retirement as early as possible. This means planning and budgeting your finances when you no longer work so you can see how much you need to retire and live a certain lifestyle.

Is a desktop investment management app better than a web/mobile one?

It is definitely not better or worse but depends on your needs. If you are constantly on the go and want to check on your assets than a desktop-only version may not be the best for you. However, if you are strict about not checking your assets while you are out of the house then a desktop-only version will suit you just fine.

Summary

These paid asset and portfolio management software all have their pros and cons and come at different price ranges as well. One thing they have in common though is a lot of work has been put into them so they can help you do the heavy lifting in your portfolio management.

We believe that Quicken is the best premium tool. Fot the very advanced, Master Investor 6 is probably the way to go.

As far as the free options go, you are probably best served with Personal Capital.

Is there a tool we may have missed? If you have experience or questions about any of the above tools, please comment below!

Michael is a senior writer at The Robo Investor. He earned his master’s at the Craig Newmark School of Journalism at CUNY, and is currently taking CFP courses at the University of Scranton. He has been an avid finance enthusiast ever since he started investing at the age of 23. Meet the Team

If you’re looking for a robo-advisor to ‘do the work for you,’ Betterment

If you’re looking for a robo-advisor to ‘do the work for you,’ Betterment

Webull, like most robo-advisors offers commission-free trades.

Webull, like most robo-advisors offers commission-free trades.

Ellevest is a robo-advisor geared toward women. It was founded by women, it’s run by women, and it focuses on women, but anyone can invest there, even men. They charge monthly fees rather than a percentage of assets under management and have three tiers to choose from.

Ellevest is a robo-advisor geared toward women. It was founded by women, it’s run by women, and it focuses on women, but anyone can invest there, even men. They charge monthly fees rather than a percentage of assets under management and have three tiers to choose from.

Folio Investing and

Folio Investing and

Vanguard is the biggest name in investments as well as the new robo-advisor industry. There are two robo-advisor options that clients can choose from:

Vanguard is the biggest name in investments as well as the new robo-advisor industry. There are two robo-advisor options that clients can choose from: Schwab is one of the biggest names in investment. Their robo advisor Schwab Intelligent Portfolios was among the top performers back in 2017. In 2019, this robo-advisor managed $40.7 billion in AUM.

Schwab is one of the biggest names in investment. Their robo advisor Schwab Intelligent Portfolios was among the top performers back in 2017. In 2019, this robo-advisor managed $40.7 billion in AUM.  One of the reasons why Wealthfront is a great option to consider is because it is considered to be the low-cost leader in the industry.

One of the reasons why Wealthfront is a great option to consider is because it is considered to be the low-cost leader in the industry.

Are you a socially responsible investor? If so,

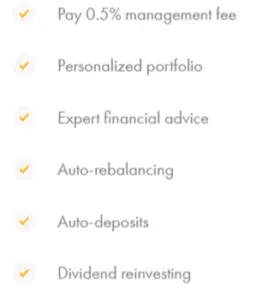

Are you a socially responsible investor? If so,  Futureadivsor is another free robo-advisor (sort of). The free services don’t involve investment management, automatic rebalancing, or tax-loss harvesting. You need at least $5,000 invested and to pay a management fee of 0.50% to get all of those services and more.

Futureadivsor is another free robo-advisor (sort of). The free services don’t involve investment management, automatic rebalancing, or tax-loss harvesting. You need at least $5,000 invested and to pay a management fee of 0.50% to get all of those services and more.

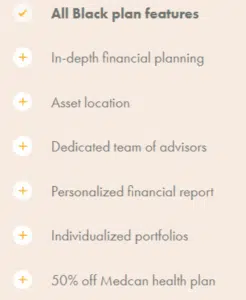

Basic is for beginners with an account balance of up to $100,000.

Basic is for beginners with an account balance of up to $100,000.