Attention!

For those interested in long-term investments, I now wholeheartedly recommend Bitcoin as the primary option to consider.

However, it’s essential to educate yourself about this digital asset before diving in, as it can take time to fully grasp its intricacies and potential.

A fantastic starting point is the book “The Bitcoin Standard” (Amazon), which provides an in-depth look at the history, principles, and technology behind Bitcoin.

Once you’re ready to invest, most major exchanges offer similar fees and services, so choose one that best suits your needs. Personally, I use Crypto.com.

It’s crucial to transfer your Bitcoin to a secure wallet once you’ve made your purchase, as leaving it on an exchange can pose risks.

To truly make the most of your investment in Bitcoin, take the time to study and understand its workings. Your financial journey will benefit from a well-informed approach.

I wish you the best in your endeavors.

Sincerely

Michael J. Peterson

.

It sounds like a new term or some new-fangled approach, but smart beta investing has been around since the 1970s. We just didn’t hear about it much.

So what is the new hype in smart beta ETFs? Is it something you should know and/or jump on the bandwagon with or should you avoid it?

Are you ready to find out more? Check out the guide below.

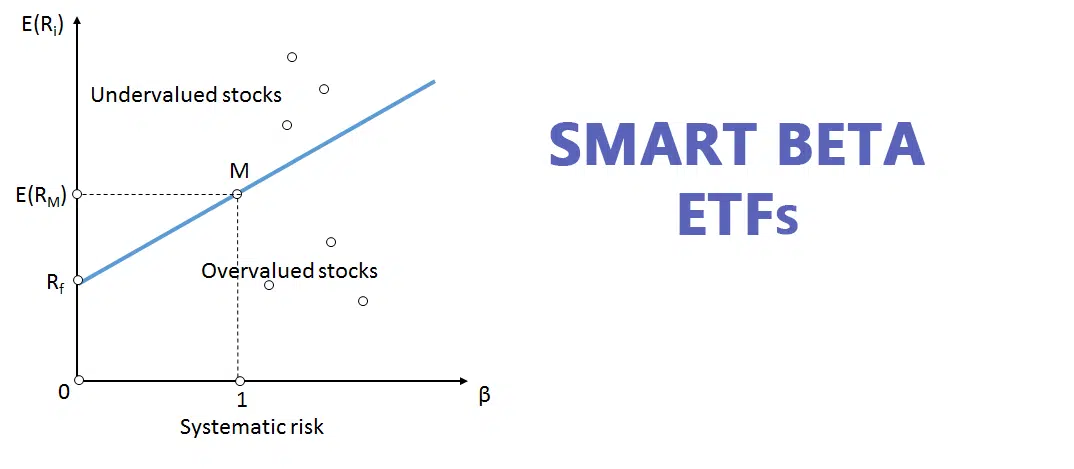

What is Beta?

Let’s start with the basics – what is beta?

Beta is the measurement of a stock’s volatility compared to an index, typically the S&P 500. The S&P 500 tracks the movements of the top 500 stocks in the United States. The beta measures how a stock compares to the index.

The S&P 500’s beta is 1.0, always. It’s the beta of a stock that you care about. This measures how the stock will perform compared to the index. A stock with a beta of 1.0 means it will move with the S&P 500.

That’s easy enough to follow, but what about a stock with a beta higher than 1.0?

Stocks with a beta higher than 1.0 indicate their volatility. They have greater movements in relation to the S&P 500. A beta of 1.5 means the stock is 50% more volatile than the S&P 500. If the S&P 500 moves 15%, the stock will move 22.5%.

This goes both ways, though. If the S&P falls, the stock will fall accordingly.

How do you measure a stock’s beta?

The general rule of thumb is that the higher the beta, the more volatile (and possibly risky) the stock is.

If you want a ‘low risk’ investment, stick with investments with a smart beta as close to 1.0 as possible. But, if you’re in it to win it, you may want to take some chances and choose investments with higher betas for the chance of earning greater returns.

What is Smart Beta?

Smart beta takes traditional beta strategies to a new level. How so?

Smart beta tries to beat the benchmark index (such as the S&P 500) rather than match it.

This isn’t like actively managed funds where the advisor strategically chooses individual investments known to beat the index. Smart beta creates a diversified portfolio with higher returns and reduced risk by looking at specific factors or indicators (screens).

What’s the best thing about smart beta investing?

You’ll pay lower fees as you’re still investing in low-cost ETFs rather than actively managed individual funds.

Smart beta investments don’t rely on market exposure or capitalization. This may be one factor, but not the only factor. Smart beta considers multiple factors that may make the investment risky or help it provide healthy returns.

In smart beta investing, you choose your factors (screens) and choose the investments accordingly. Think of it as a combination of active and passive investing.

What is Alpha?

If we talk about beta, of course, we must talk about alpha too, right?

Beta focuses on an investment’s volatility. Alpha measures the portfolio’s returns and expected performance. What’s the difference? How does it compare to the beta or risk level?

Alpha is indicated by how the fund reacted compared to the S&P 500 (or another index). Funds that perform better than the index have a higher alpha and funds that perform worse than the index have a lower alpha. Funds that walk the same line as the index have a 0 alpha.

What are Smart Beta ETFs?

If you’re investing with a robo-advisor, chances are you’ll come across smart beta ETFs. These passive investments follow a rules-based system when choosing which stocks get included. The fund tracks an index, (like the S&P 500), but only includes those that meet the chosen metrics.

Smart beta ETFs don’t focus on a company’s size or market capitalization, but rather individual factors that affect its performance. The ETF then prioritizes the funds based on how they perform against the chosen metrics. The goal is to lower the risk and increase the returns using the beta method.

What Robo Advisors Use Smart Beta?

As smart beta increases in popularity, more robo-advisors will jump on board. For now, the following robo-advisors use this tactic:

Betterment

Betterment

Betterment instituted smart beta funds a few years ago, but they still align with their core principals including personalized planning, finding the balance between cost and value, optimizing tax liabilities, and diversifying.

Wealthfront

Wealthfront

Wealthfront offers smart beta investing for its largest investors with balances of $500K or higher. Wealthfront offers this service at no additional cost to its standard management fee.

Sofi Invest

Sofi Invest

SoFi offers the SoFi 50 ETF index fund that tracks the Solactive SoFi US 50 Growth Index. It uses three metrics to choose the funds including revenue growth, income growth, and future analysis. Read an in-depth review here.

Here is the complete list

- Betterment

- Wealthfront

- SoFi Invest

- Charles Schwab

- Personal Capital

- Vanguard

- Interactive Advisors

- Fidelity Go

- Wealthsimple

- E*Trade Core Portfolios

- Titan Invest

FAQ

Is smart beta active or passive investing?

Smart beta is a combination of active and passive investing. It provides you with the best of both worlds, to maximize your earnings. It looks at alpha and uses it as one of the factors, but it focuses on a variety of other factors that choose funds that mimic and/or beat the market index.

Why is beta important?

Investors consider beta because it measures the risk an investment has regardless of diversification. It looks at an entire portfolio, not an individual stock. The entire portfolio (ETF), has a beta and that beta determines how the fund moves compared to the index.

What is the beta of the S&P 500?

The S&P 500 has a beta of 1.0. That doesn’t change. That’s your benchmark to compare the beta of other investments. The higher beta is, the more volatile the fund is compared to the S&P 500. This can signify the chance for great losses and great returns.

What is a good beta?

This is a personal decision. A beta that is higher than 1.0 indicates that a fund will move the indicated amount more than the index. For example, an index of 1.2 means it will move 20% more than the index moves.

A beta that is lower than 1.0 indicates that a fund will move less than the index. This indicates a more conservative fund, but also means lower returns.

Who should consider smart beta investing?

Smart beta helps investors diversify risk. You look for ETFs that outperform the market, rather than mimic it. Smart beta products may provide greater returns, but of course, all returns come with risk, so they also have a higher risk.

Bottom Line

Should you focus on smart beta strategies? It’s a personal decision, but one that may benefit your portfolio.

If you’re just starting, smart beta strategies shouldn’t be at the top of your list, but it should be something you work toward as you get your footing and understand your risk tolerance.

Robo Chooser

Use the following Quiz and find out which robo advisor is best for you.

Michael is a senior writer at The Robo Investor. He earned his master’s at the Craig Newmark School of Journalism at CUNY, and is currently taking CFP courses at the University of Scranton. He has been an avid finance enthusiast ever since he started investing at the age of 23. Meet the Team

Betterment

Betterment Wealthfront

Wealthfront Sofi Invest

Sofi Invest