Attention!

For those interested in long-term investments, I now wholeheartedly recommend Bitcoin as the primary option to consider.

However, it’s essential to educate yourself about this digital asset before diving in, as it can take time to fully grasp its intricacies and potential.

A fantastic starting point is the book “The Bitcoin Standard” (Amazon), which provides an in-depth look at the history, principles, and technology behind Bitcoin.

Once you’re ready to invest, most major exchanges offer similar fees and services, so choose one that best suits your needs. Personally, I use Crypto.com.

It’s crucial to transfer your Bitcoin to a secure wallet once you’ve made your purchase, as leaving it on an exchange can pose risks.

To truly make the most of your investment in Bitcoin, take the time to study and understand its workings. Your financial journey will benefit from a well-informed approach.

I wish you the best in your endeavors.

Sincerely

Michael J. Peterson

.

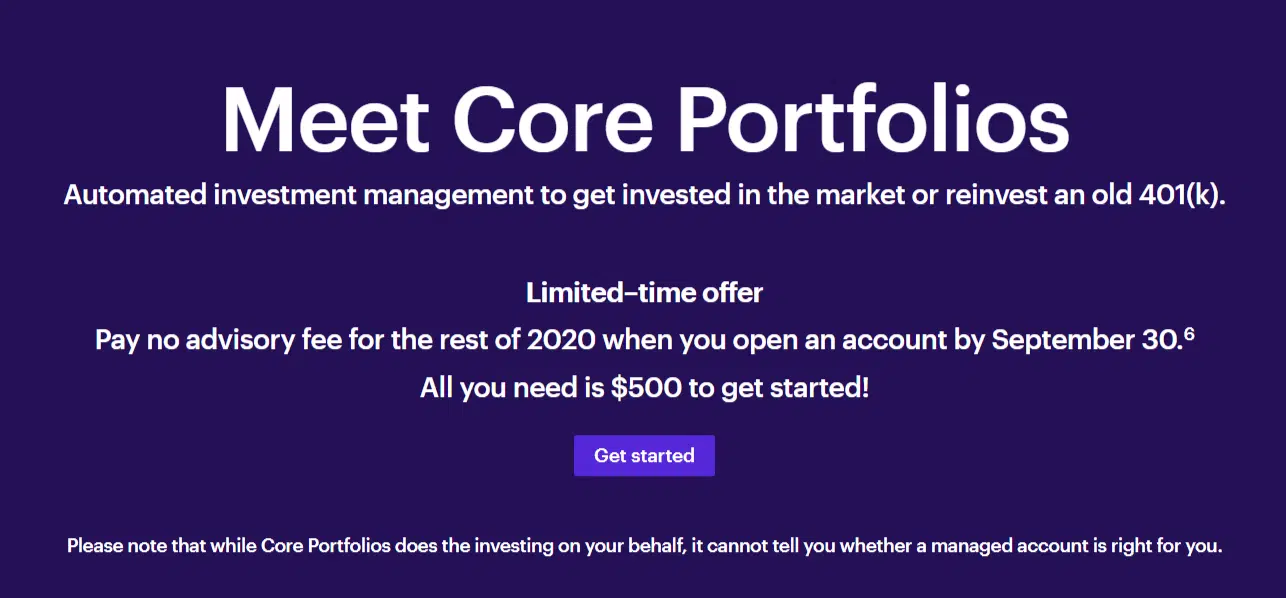

E*TRADE Core Portfolios is E*TRADE’s version of a robo-advisor. Known for its low expense ratios and household name, cost-conscious investors and investors looking for a hands-off experience choose E*TRADE.

E*TRADE prides itself on its low expense ratios and assortment of educational resources, helping investors meet their investment goals.

Check out this E*TRADE Core Portfolio review to see if it’s right for you.

What is E*TRADE Core Portfolios?

You’ve likely heard of E*TRADE as it’s a household name in investing. Core Portfolios is E*TRADE’s latest installment, meant for beginners and investors looking for low-cost managed portfolios.

You need just $500 to start and E*TRADE invests in low-cost ETFs that match your risk profile and goals. Core Portfolios works much like many other robo-advisors, but it has its unique quirks setting it apart from the competition. If you’re looking for a hands-off investment approach to complement your E*TRADE account or to make your first investment, keep reading to find out more.

How does it work?

Account Opening

Open an account with just $500. Core Portfolios offers individual and joint taxable accounts. You may also open custodial accounts for your children and IRAs.

Like most robo-advisors, the process starts with a questionnaire. E*TRADE’s questionnaire contains 9 questions. You’ve likely seen the questions before if you’ve used a robo-advisor, however, E*TRADE spins them with a few different angles to get a true understanding of where you stand.

After answering the questions, E*TRADE provides a recommended portfolio showing you the asset allocation (stocks vs bonds percentage) but not the exact investments they recommend, until you create the portfolio. You’ll have an idea of how they’ll invest your money, but no specific details until later down the road.

Deposit and withdrawal

E*TRADE encourages automated deposits to keep your account growing, but you can use their various other funds transfer options on the Move Money page. If you have another E*TRADE account, you may transfer funds easily with the intra-firm transfer tool.

You may also transfer existing securities rather than cash. E*TRADE performs the transfers commission-free.

You may also start withdrawals online. E*TRADE tells you how the withdrawal affects your account, including the tax liabilities should there be capital gains. The advisory then withdraws from your cash balance first and then sells investments based on your investment allocation and what affects your taxes the least. If you’ll incur tax liabilities, you should consider your options carefully.

Interface

E*TRADE has a digital dashboard on both the desktop and mobile platforms. Many clients prefer the mobile app, which allows most of the same transactions, including withdrawals. It takes minutes to open an account, transfer funds, or make changes on either platform, but you’ll get more detailed information about fees on the desktop platform.

What can you trade?

Core Portfolios trades ETFs only. They have 5 key portfolios to choose from which they present to you after you complete your risk profile.

When E*TRADE provides you with your portfolio, they also provide alternative portfolio choices. They include socially responsible ETFs and smart beta ETFs.

E*TRADE Core Portfolios trades ETFs from iShares, Vanguard, and JP Morgan. E*TRADE presents you with a recommended portfolio, but you may choose a more aggressive or more conservative portfolio based on your preferences.

Costs

E*TRADE charges 0.3 percent of assets annually under management for their part of the pie, but you’ll also pay expense ratios. Each ETF has a different ratio, but on average they charge 0.06 percent to 0.12 percent per ETF.

E*TRADE also charges a $75 fee for a full transfer out or $25 for a partial transfer out.

Additional features

- Cash account – E*TRADE holds all cash balances in a premium savings account or money market account, paying you a competitive APY.

- Customer service – You can reach representatives Monday – Friday 8:30 AM to 8:30 PM Eastern time via phone or 24/7 via online chat.

- Research – Core Portfolios doesn’t have specific research options, but E*TRADE provides access to all its research and education on its main website. This includes retirement planning and financial planning tools and various research tools.

- Education – E*TRADE sends a monthly newsletter complete with market talk pertaining to the ETFs in the portfolios. All clients have access to E*TRADE’s educational center too which includes video and written content.

- Rebalancing – E*TRADE rebalances accounts semi-annually or whenever the cash balance exceeds 6 percent of your account balance.

Tutorial

Pros and Cons

FAQ

Is E*TRADE Core Portfolios secure?

E*TRADE uses high-level encryption, and all accounts have SIPC protection up to $500,000 and excess protection up to $600,000,000 with London Insurance.

Is E*TRADE Core Portfolios for beginners?

E*TRADE doesn’t offer the handholding that other robo-advisors offer. They started the program as an add-on to its already robust offerings. If you don’t have a solid understanding of how investments work, you may want to look elsewhere.

What is the cash value target?

E*TRADE aims for a 1 percent cash value. They invest the cash in an interest-bearing money market or other alternatives. While you don’t want a large cash balance as there’s an opportunity cost there, having some cash on hand is important.

Does Core Portfolios offer self-directed investments?

No, Core Portfolios is for the hands-off investor that uses the combination of human advisors and technology to create an optimized allocation. If you open a Core Portfolios account, you agree to let E*TRADE manage your account and choose the investments.

Do you need a $500 balance if you have other E*TRADE accounts?

Yes, the $500 minimum balance is irrespective of any other E*TRADE accounts. This means even if you have other E*TRADE portfolios, their balance doesn’t count toward the $500 minimum balance required for Core Portfolios.

Does Core Portfolios offer 401K assistance?

No, but you can roll over an old 401K to your E*TRADE Core Portfolio account. If you have a 401K, you can’t use Core Portfolios to manage it, I would suggest you take a look at a Robo-Avdisor called Bloom instead.

Does E*TRADE have brick-and-mortar locations?

Yes, E*TRADE has 30 locations throughout 17 states. If you live near a brick-and-mortar location, you may visit them in person to get advice and help. If you don’t, there are plenty of opportunities for support over the phone or online.

Alternatives

E*TRADE vs TD Ameritrade

TD Ameritrade invests across 8 asset classes and incudes socially responsible investments. You may open a taxable or retirement account and TD Ameritrade offers tax loss harvesting on all accounts.

E*TRADE vs Interactive Brokers

Interactive Advisors rebalances your account quarterly and lets you see your investments and positions at any time. They create your portfolio based on your goals and risk tolerance, like most other robo-advisors, and charge between 0.08 percent and 1.5 percent in management fees.

E*TRADE vs Robinhood

What sets Robinhood apart is its available investments. Most robo-advisors stick to ETFs, but Robinhood offers stocks, options, and cryptocurrency too. If you’re looking for robust customer service, you’ll want to look elsewhere, as you’ll only find it online and via email.

E*TRADE vs Fidelity Go

This doesn’t mean you’ll get access to financial advisors though – they manage your money but they don’t talk to clients. You need just $10 to invest and pay no management fees until you have at least $10,000 invested.

Current Promotions

There are currently no promotions.

Worth It or a Scam?

E*TRADE Core Portfolios is worth it for the hands-off investor with a decent understanding of investments but don’t have the time to be bothered with managing them. The fees are in line with most other robo-advisors and the investments have low expense ratios, giving you more of your earnings.

Summary

E*TRADE Core Portfolios is great for existing E*TRADE clients and new clients looking for a hands-off way to invest. They use the same methodology other robo-advisors use, assessing your risk profile and implementing the Modern Portfolio Theory.

If you’re looking for human support, you may look elsewhere as most of your contact is online and with a computer, not a person. But casual investors looking for a place to park their money do well with E*TRADE.

Robo Chooser

Use the following Quiz and find out which robo advisor is best for you.

If you have any questions, please comment below.

Michael is a senior writer at The Robo Investor. He earned his master’s at the Craig Newmark School of Journalism at CUNY, and is currently taking CFP courses at the University of Scranton. He has been an avid finance enthusiast ever since he started investing at the age of 23. Meet the Team