Attention!

For those interested in long-term investments, I now wholeheartedly recommend Bitcoin as the primary option to consider.

However, it’s essential to educate yourself about this digital asset before diving in, as it can take time to fully grasp its intricacies and potential.

A fantastic starting point is the book “The Bitcoin Standard” (Amazon), which provides an in-depth look at the history, principles, and technology behind Bitcoin.

Once you’re ready to invest, most major exchanges offer similar fees and services, so choose one that best suits your needs. Personally, I use Crypto.com.

It’s crucial to transfer your Bitcoin to a secure wallet once you’ve made your purchase, as leaving it on an exchange can pose risks.

To truly make the most of your investment in Bitcoin, take the time to study and understand its workings. Your financial journey will benefit from a well-informed approach.

I wish you the best in your endeavors.

Sincerely

Michael J. Peterson

.

Do you have an investment strategy or do you wish someone would tell you how and where to invest?

Folio Investing provides just what you need whether you know where you want to invest and in what allocations or you want someone to do it for you.

Check out my review to see if Folio Investing is worth it or not.

What is Folio Investing?

Folio Investing is a robo-advisor with a twist. You can choose the traditional premade folios, like most robo-advisors offer or you can create a custom folio.

You also have the option to choose a Ready-to-Go Folio and customize it. Folio emphasizes long-term investing with diversified assets in as many as 100 securities.

How does it work?

Account opening

Opening an account at Folio is simple. There is no minimum deposit requirement and each investor creates a ‘folio’ or portfolio. You provide your personal identifying information, link your bank account, and answer questions about your risk profile and goals. Folio then sets up ‘folios’ for you.

Folio’s ‘folios’ are baskets of securities or portfolios.

Each folio may contain from 1 to 100 securities and include fractional shares. You may have as many folios as you want/can afford. If you prefer Ready to Go Folios, you have more than 100 baskets to choose from. If you customize your folio, you also choose the weight of each asset – whether you equally weight all assets or customize each asset’s weight.

Deposit and withdrawal

Once you open an account, transferring money is simple. Open the Transfers page on your dashboard and select deposit. Follow the on-screen instructions, but you can deposit funds via electronic transfer, check, wire, direct deposit, or your bank’s Bill Pay service.

Withdrawals work the same way. Select Transfers from your dashboard and then withdrawals. You can withdraw funds via electronic transfer, check, or wire transfer. Only account owners with an account manager or owner titles may withdraw funds. Folio allows users with ‘Account Detail Viewer’ status to view your account, but they cannot make changes including withdrawals.

Interface

Folio’s platform helps you determine the type of investor you are and then gives you choices. Whether you create custom folios or use the Ready to Go Folios, they help you through the process. The interface is easy to use for any investor.

Its interface is a bit antiquated, so don’t expect anything out of the ordinary or very modern. It does its job and that’s it.

Accounts

Investors may open any type of investment account including individual and joint taxable accounts, custodial and trust accounts, retirement accounts including traditional and Roth IRAs, and Simple/SEP IRAs.

Costs

Folio Investing has a Basic and an Unlimited Plan:

Basic plan

$15 per quarter for each funded account that makes less than 3 trades per quarter.

The Basic Plan includes:

- Unlimited taxable and retirement accounts

- Unlimited folios, with each folio containing 1 to 100 assets

- Access to the Ready to Go Portfolios

- $4 for each window trade (per security)

- No required account balance

- $10 fee for market, stop, limit, or stop-limit orders

Unlimited plan

$29 a month or $290 per year.

The Unlimited Plan includes:

- Unlimited taxable and retirement accounts

- Unlimited folios, with each folio containing 1 to 100 assets

- Access to Ready to Go Portfolios

- Up to 2,000 trades with no commissions in two daily window trades

- $0.50 for each additional security trade

- No required account balance

- $3 for market, stop, limit, or stop-limit orders

Folio also charges some ‘special fees’:

- $100 full transfer out to another broker

- $20 per check withdrawal

- $12.50 per paper copy statement

- $45 per broker-assisted trade (via telephone)

- $25 per year IRA custodial fee

- $15 per quarter for balances left over after account closed

Folio’s mutual funds are no-load mutual funds. But they may have fees that the mutual fund company deducts right from the fund assets.

Additional features

Cash account

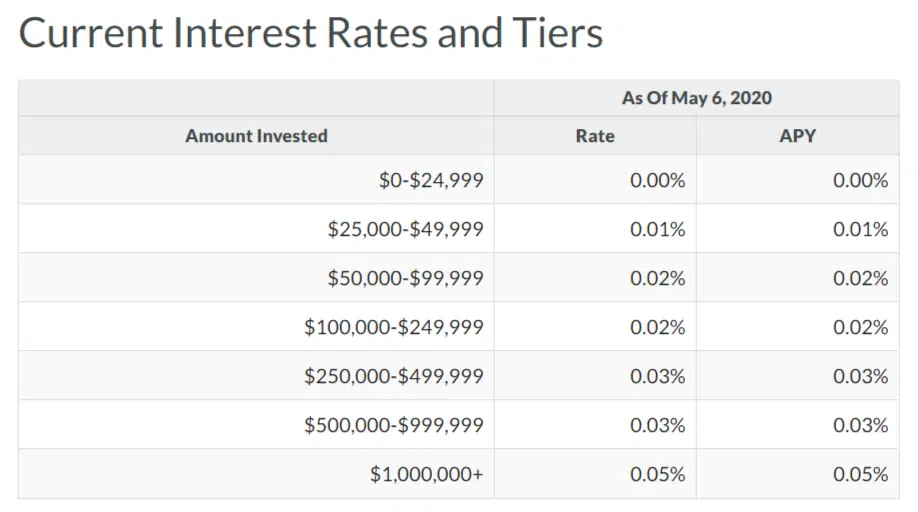

Folio offers a Cash Sweep program which ‘sweeps’ your uninvested cash into an FDIC insured interest-bearing account. The interest rates aren’t anything to get excited about – they match the interest rate you’d receive in your local bank’s checking account, but it’s better than leaving the cash not earning any interest.

The Cash Sweep program has tiered interest rates, though. The more cash you ‘sweep’ the higher the interest rate. This shouldn’t be an incentive to have cash, but if it happens, you know it can early a little interest. The Cash Sweep program provides access to check-writing and automated cash transfers.

You also have the option to ‘invest’ in FDIC PLUS, Folio’s highest-tier cash program. You invest your cash and earn money-market like rates.

Human advisors

Folio does offer broker-assisted trades, but at $45 a trade, you’re better off learning how to manage the trades yourself.

Customer service

Folio offers customer service via phone, email, or online chat. Customer service reps are available weekdays 7 AM – 9 PM ET; weekends 8 AM – 4 PM ET.

Research

Folio uses QuoteMedia for its stock research. You can view quotes, charts, financial analyses, and historical data.

Window Trading

Folio offers window trading, which could be good or bad, depending on how the market goes. Window trading means they only trade at certain times of the day. Basic members have one window and unlimited members have two. This means when the trade executes, it may or may not trade at the price that triggered the sale.

Virtual trading account

You can open a free watch account to test the waters before you invest with Folio. You trade ‘fake money’ in real-time to see how you’d do. You can have up to 10 watch folios to try out your own portfolios or to mimic a professional investor’s portfolio without risking your money.

Folio Investing Pros and Cons

FAQ

Does Folio Investing trade bonds?

Yes and no. Folio trades bonds in fixed-income ETFs, but they don’t trade individual bonds. If you want conservative investments, you can choose one of the Ready to Go Folios made for conservative investing but that has a decent amount of diversification.

Do you have to sign up for the Cash Sweep option?

No, Folio Investing automatically enrolls every investor in the Cash Sweep program. They’ll hold your funds in their FDIC insured account or into a partner FDIC insured bank. The accounts have extended FDIC insurance, covering deposits in the millions. If you want a higher interest rate or better returns, consider the FDIC Plus Sweep program.

Is there a required minimum balance for Folio Investing?

No, investors with any amount of money may invest at Folio. You don’t need a minimum or maximum for trading either. You invest with the amount you have, and can even buy/trade fractional shares if you want.

How do you create your own folio?

If you don’t like any of the Ready to Go Folios or you want to try your hand at investing, click ‘Add New Folio’ on your account page and follow the on-screen instructions. You can construct your entire portfolio or take an RTG Folio and customize it to your liking.

What can you trade?

Investors can trade stocks, ETFs, and mutual funds. You can buy in fractional shares or whole shares and include as many as 100 investments in one folio. If you want to trade crypto you’re probably better off with a robo advisor like RobinHood.

Did Folio buy Motif?

Yes. As of May 20, 2020, Motif closed down and sold its accounts to Folio. All Motif investors automatically were enrolled in Folio’s unlimited investing plan.

What is a Ready-to-Go Folio?

A Ready-to-Go Folio is a pre-built portfolio. They are great for beginning investors or those that want a passive investment. With as many as 100 securities in one folio, it’s a great way to diversify without the work. You can even customize an RTG if you want to remove/replace a few securities.

How is Folio investing different from mutual funds?

Mutual funds are investments in a variety of companies managed by an account advisor. You don’t own the underlying securities, but a piece of the securities with mutual funds. With Folio, you own the securities themselves and can buy/sell them as needed. With mutual funds, you’re at the mercy of the investment manager’s decisions.

How does Folio Investing make money?

Folio Investing makes money in many ways, starting with their monthly or quarterly fees. They also charge commission fees and have margin accounts, which they earn interest on when investors borrow to trade.

Alternatives

Folio Investing vs M1 Finance

M1 has lower margin rates and doesn’t offer mutual funds, whereas Folio does offer mutual funds, but doesn’t encourage them. M1’s dashboard is a bit more intuitive and modern, whereas Folio’s is a bit ‘old school.’

Folio Investing vs RobinHood

Robinhood has been around for a while now

Once you answer the platform’s questions, Robinhood chooses a portfolio for you, manages it, and reallocates it as needed. Robinhood is great for millennials or anyone who prefers to trade on their mobile phone.

Current Promotions

First 60 days off for unlimited plan.

Folio Investing – Worth It or a Scam?

Folio Investing focuses on diversification. If you have a hard time diversifying or don’t know where to invest, it’s a great option. According to Folio Investing, investors lose as much as 50 percent of their potential lifetime earnings by not diversifying, making Folio a great option for those who’d rather not lose such potential.

Summary

Folio Investing offers the best of both worlds. They’ll invest for you, allowing you to just sit back and passively earn. They offer customization of a Ready-to-Go portfolio, allowing you to get some hand-holding while customizing your portfolio or completely starting your portfolio from scratch.

It’s great for beginning and experienced investors and is a great way to minimize taxes and maximize your investments. The fees are a bit on the higher end, however the flat fee model also allows for more transparency.

If you are still undecided, use the following tool to find out which robo best fits your investing needs:

Robo Chooser

Use the following Quiz and find out which robo advisor is best for you.

If you have any questions, please comment below.

Michael is a senior writer at The Robo Investor. He earned his master’s at the Craig Newmark School of Journalism at CUNY, and is currently taking CFP courses at the University of Scranton. He has been an avid finance enthusiast ever since he started investing at the age of 23. Meet the Team