Attention!

For those interested in long-term investments, I now wholeheartedly recommend Bitcoin as the primary option to consider.

However, it’s essential to educate yourself about this digital asset before diving in, as it can take time to fully grasp its intricacies and potential.

A fantastic starting point is the book “The Bitcoin Standard” (Amazon), which provides an in-depth look at the history, principles, and technology behind Bitcoin.

Once you’re ready to invest, most major exchanges offer similar fees and services, so choose one that best suits your needs. Personally, I use Crypto.com.

It’s crucial to transfer your Bitcoin to a secure wallet once you’ve made your purchase, as leaving it on an exchange can pose risks.

To truly make the most of your investment in Bitcoin, take the time to study and understand its workings. Your financial journey will benefit from a well-informed approach.

I wish you the best in your endeavors.

Sincerely

Michael J. Peterson

.

Ellevest is a robo-advisor that was created by women for women. It’s a diverse investing platform that helps women in all stages of life find financial freedom.

The founder, Sallie Krawcheck, started Ellevest when she couldn’t find a gender-neutral solution that supported women and their investing needs.

Is Ellevest legit? I share my experience with the platform below.

What is Ellevest?

Ellevest takes women’s interests, capabilities, and earnings and puts them to work. They use the foundation that women still make less than men, yet most of the investing models out there focus on men and their salaries.

Where does that leave women? That’s where Ellevest feels that it fills a void. They provide solutions for women that work.

This isn’t about women investing in a man’s world – this is about women investing in a woman’s world.

They use data from real women to come up with their investment strategies to reach the goals that women set. Moreover, They also give you the option to invest in companies that support and advance women.

How does it work?

Ellevest considers many factors when creating your portfolios including:

- Your salary

- Marital status

- Dependents

- Goals

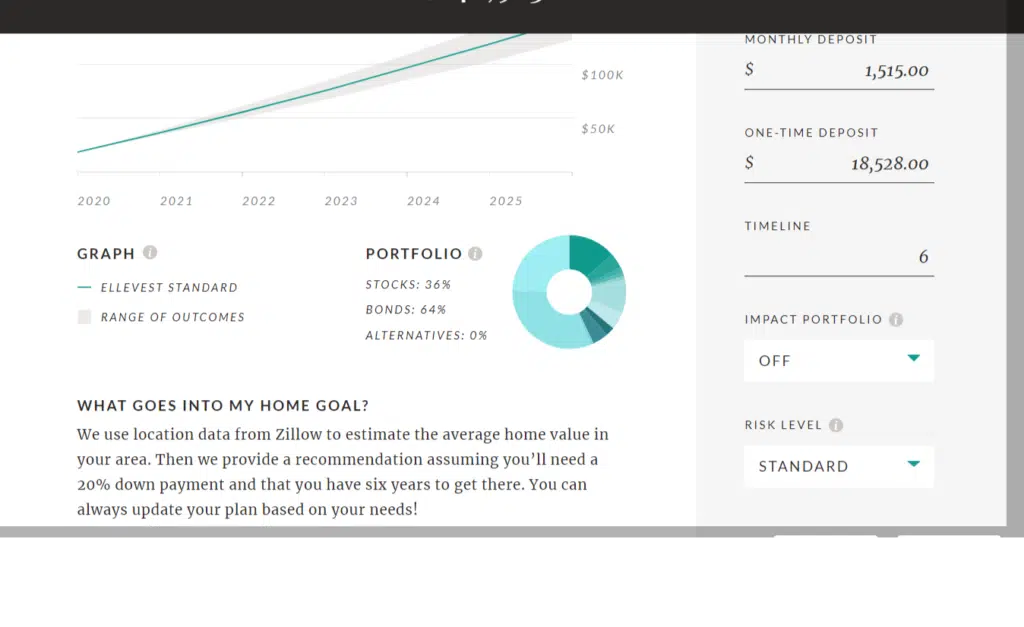

Ellevest uses this information to create portfolios that aim to give you a 70% chance of reaching your goals. Each goal has its own investment portfolio. You can adjust the plan at any time and they’ll automatically adjust your portfolio to help you reach your goals. You can also transfer shares between your goals if you decide to make changes, such as increase or decrease a goal.

Account Opening

In my experience with Ellevest, it took all of 10 minutes to get started. They certainly make it easy with just a few steps:

- Start by answering questions about your current life, finances, and financial goals

- Link your bank account for funding

- Ellevest creates your portfolios

Ellevest Digital doesn’t have any minimum balance requirements. You can invest as little or as much as you want. If you invest in Ellevest Premium, however, you must have a $50,000 minimum balance. Of course, you can’t invest until you have money in your account, so it’s to your benefit to fund your account as quickly as possible.

Deposits and Withdrawals

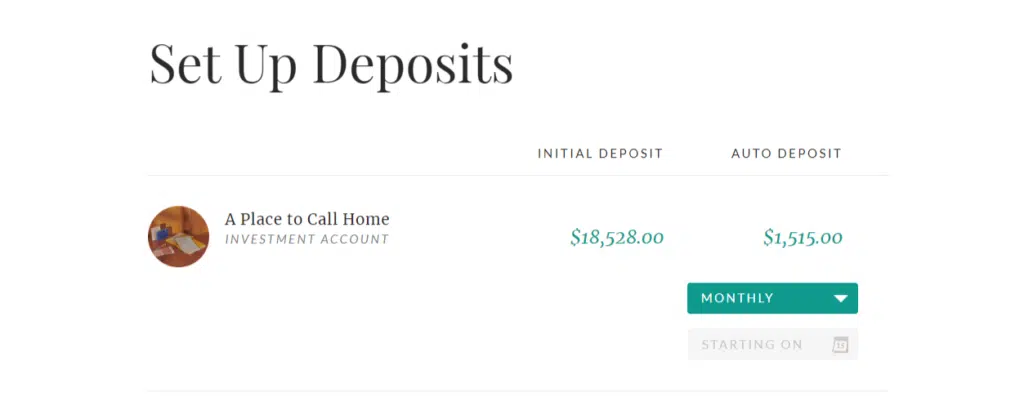

Once you open your account, you’ll link your bank account to your Ellevest account. Any deposits you make will have a waiting period of two to three days, depending on your bank before Ellevest will invest it. This gives Ellevest time to ensure that the deposit goes through.

You may withdraw funds from Ellevest that have been in the account for at least five days with no penalty. Keep in mind, though, there may be penalties and taxes on money withdrawn from a tax-advantaged account, such as an IRA. Talk with your tax advisor before withdrawing funds to see how it will impact your tax liabilities.

Interface

Ellevest’s interface is user-friendly and clean. It’s clearly targeted to women and asks very gender-specific questions to help you get started. Its platform takes no more than 5 minutes to get up and running. If you have questions, there are prompts throughout the entire system that helps you understand what comes next and what questions you should ask yourself.

When you are set up, the interface is simple to navigate, letting you know as soon as you long in where your investments stand. While Ellevest’s customer service is great, you can often answer your own questions by looking at the robust interface.

What can you Trade?

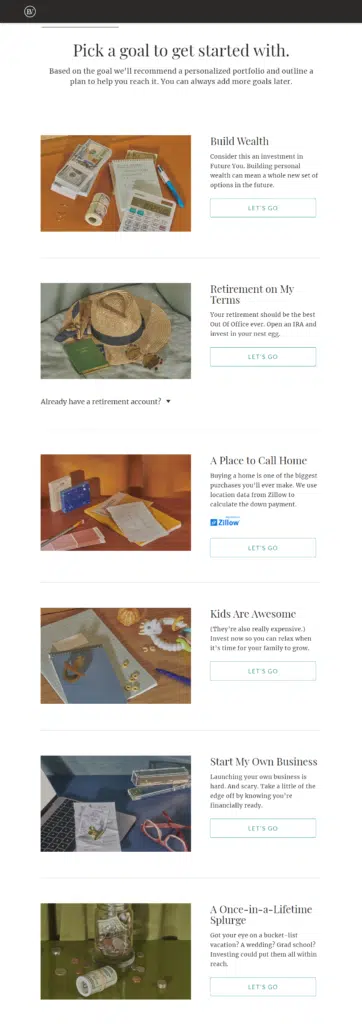

Ellevest has investment routes to choose from including buying a house, building an emergency fund, retirement, starting a business, having a child. Based on your answers Ellevest then diversifies your funds in the following investments:

- Stocks

- Bonds

- ETFs

- Mutual funds

Costs

Ellevest prides themselves on their simple and flexible pricing. As I talked about a bit above, they have two, actually three investment options. Most women start with Ellevest Digital, which is an online tool that uses algorithms based on your income, gender, and your age. There’s no minimum investment requirement, and you’ll pay 0.25% of your total amount invested.

Ellevest Premium takes the digital plan one step further.

You get the same features as Ellevest Digital, plus one-on-one career and financial coaching. You need a minimum balance of $50,000 and you’ll pay 0.50% of the amount invested.

Ellevest’s Private Wealth program is for those with $1 million or more to invest.

Women in this category get one-on-one portfolio management and the fees are based on the assets currently being managed, rather than one set fee.

In addition to the account management fees, you may pay fees to sell securities. You may also pay IRA fees, mutual fund sales loads, and other miscellaneous fees. For example, there may be paper statement fees, bounced check fees, or early redemption fees. Make sure to read the fine print on your agreement before opening an account.

Ellevest PROs and CONs

Additional features

Are there Human Advisors?

All Ellevest investors have access to the Ellevest Concierge Team. The team can help you roll over or consolidate IRAs and 401Ks, create and customize your financial goals, get financial guidance, and ask questions over the phone, chat, or email.

Ellevest premium investors, which are those with at least a $50,000 balance, do have access to one-on-one advisor support from a Certified Financial Planner. The CFP can provide finance and money advice and the career coaches provide executive coaching to help you elevate your career.

Customer Service

Ellevest investors can reach Ellevest customer service representatives Monday – Friday 9 AM to 6 PM via phone, text, and Facebook Messenger. If there’s an urgent matter over the weekend or evening, you can utilize email support.

Screenshots / Tutorial

1. Get started

2. Choose a goal

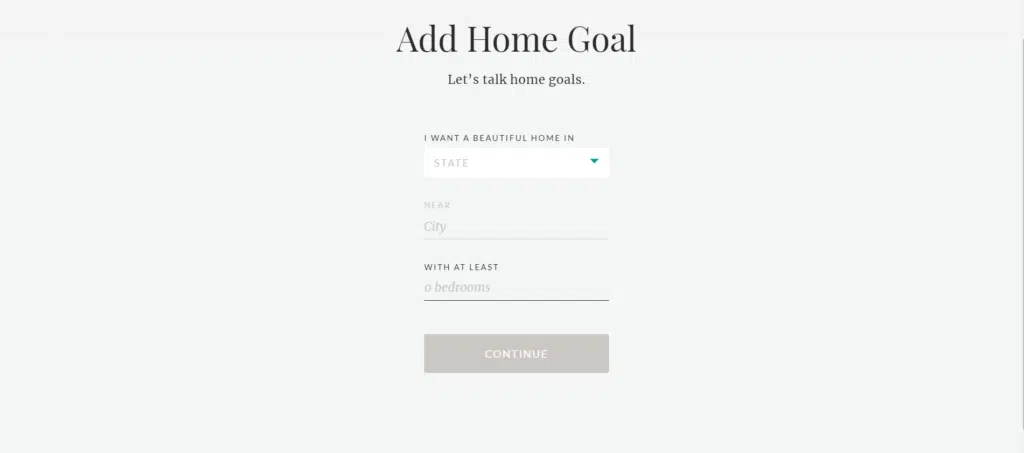

3. Specify

4. Decide Risk and Impact

5. Set up your deposit

Video

The following is a review from investing with rose. Thanks for making this awesome review Rose!

FAQ

Is Ellevest only for women?

While Ellevest is primarily for women and its data and forecasting is based on women’s salaries and longevity, men are welcome to use the platform as well. If you are not sure which robo to invest with check out our quiz to help you decide.

What does Ellevest do differently?

The portfolios are designed according to your specific profile. Furthermore, a gender-specific salary curve is used to build the portfolio. Ellevest designs portfolios that are designed to help you reach your goals in 70% of markets. Portfolio adjustments are made to keep you on track.

How is the risk level determined?

Upon combining your parameters such as how much money you need, the kind of investment you are looking to make and the desired time horizon, Ellevest will invest in a mix of stocks, bonds, and alternatives which are designed to help you reach that goal in 70% of markets.

Risk depends on whether your goals are short term or long term. Due to market fluctuation it is best practice to invest conservatively when your goal is short term (up to 6 years) However if your goal is long term you can afford to invest in a more risky portfolio.

Are there any withdrawal fees?

No. You can withdraw money at any time. There are no minimum amounts or penalties.

How does Ellevest Make Money?

Ellevest makes money on the fees it charges to manage your accounts. They have a decent amount of digital and premium accounts that help them make the profits they desire while helping women learn to manage their investments wisely.

Does Ellevest try to ‘beat’ the market?

Ellevest’s primary mission is to help women achieve their goals. They don’t put a lot of emphasis on beating a specific market or index. Instead, it focuses on how to help you achieve the goals you set, whether short-term, mid-term, or long-term.

What is impact investing?

Ellevest gives you the opportunity to invest in funds that promote sustainability and ethical practices. They also invest in companies that support and advance women.

Can you set up automatic deposit for your Ellevest account?

Yes, you can customize how often your money deposits into your investment account. You can choose from monthly, quarterly, or twice a month deposit options. You can also have a portion of your paycheck deposited if you wish.

How long does it take to withdraw funds from your Ellevest account?

It can take up to 7 days for a transfer to complete. It typically takes 1 -2 business days to get the process started and another 3 days for the transactions to settle (sell the securities). Finally, it takes 1 – 2 days to transfer the funds to your account.

How often are portfolios rebalanced?

Ellevest doesn’t rebalance on a specific schedule. Instead, they look closely at your goals and how well your account is meeting those goals. If your securities veer far from the stated goal, Ellevest will rebalance the portfolio accordingly.

When is Ellevest customer service available?

You can reach Ellevest customer service Monday – Friday 9 AM to 6 PM, as well as via email at any time at concierge@ellevest.com

Current Promotions

Ellevest currently doesn’t have any promotions.

Worth It or a Scam?

Ellevest is a viable company that supports women and their investing needs. They have low costs and offer plenty of selection for women to choose from to help them reach their goals. Because it’s a robo-advisor, you don’t have to worry about managing the portfolio yourself – everything is done for you after you answer a few simple questions and fund your account. It doesn’t get much easier than that.

Alternatives

Ellevest vs Betterment

Betterment also charges lower fees, but they don’t have the unique aspect of being for women, which is why women pay the higher fees for Ellevest to get the unique investing options made for women. Check out the full comparison here.

Ellevest vs Acorns

Acorns does allow other fund transfers to build up your account faster and they charge lower fees than Ellevest, but have fewer investment options. Check out the full comparison here.

Ellevest vs Robinhood

The main difference is that Robinhood is designed for more involved investors, if you are looking for more of a hands-off approach, Ellevest will definetely be your better bet.

Summary

If you’re a woman looking for investing geared specifically toward women, Ellevest is it. While the fees are relatively low they are still slightly higher than some of its competitors’.

It offers a unique perspective that helps women achieve their goals while making it in what’s considered a ‘man’s world.’ Ellevest offers the advice and tools to help women feel empowered while investing.

Robo Chooser

Use the following Quiz and find out which robo advisor is best for you.

If you have any questions, please comment below.

Michael is a senior writer at The Robo Investor. He earned his master’s at the Craig Newmark School of Journalism at CUNY, and is currently taking CFP courses at the University of Scranton. He has been an avid finance enthusiast ever since he started investing at the age of 23. Meet the Team