Attention!

For those interested in long-term investments, I now wholeheartedly recommend Bitcoin as the primary option to consider.

However, it’s essential to educate yourself about this digital asset before diving in, as it can take time to fully grasp its intricacies and potential.

A fantastic starting point is the book “The Bitcoin Standard” (Amazon), which provides an in-depth look at the history, principles, and technology behind Bitcoin.

Once you’re ready to invest, most major exchanges offer similar fees and services, so choose one that best suits your needs. Personally, I use Crypto.com.

It’s crucial to transfer your Bitcoin to a secure wallet once you’ve made your purchase, as leaving it on an exchange can pose risks.

To truly make the most of your investment in Bitcoin, take the time to study and understand its workings. Your financial journey will benefit from a well-informed approach.

I wish you the best in your endeavors.

Sincerely

Michael J. Peterson

.

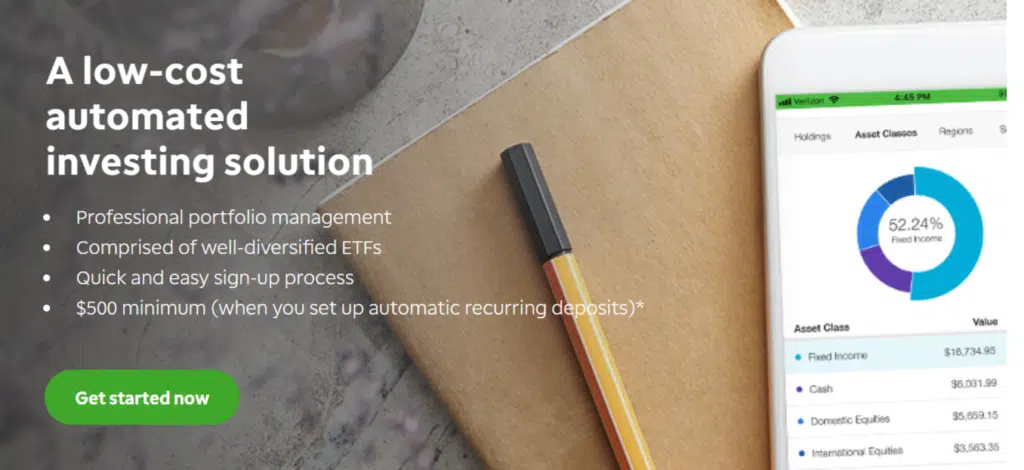

TD Ameritrade is one of the most well-known brokers available today and their offerings just keep getting better. Today they offer two programs – the Essentials Portfolios and Selective Portfolios platform.

Both platforms have the robust TD Ameritrade name, but the similarities end there.

- The Essentials Portfolio is your traditional robo-advisor and is great for those looking for ‘the essentials’ or the basics of a robo-advisor without getting overwhelmed.

- The Selective Portfolio is for investors looking for a more personalized approach. They offer human insight and a bit more personalized service with a wider selection of investments available.

What is TD Ameritrade?

TD Ameritrade has been in business for the last 40 years, helping investors make the most of their portfolios. Today, TD Ameritrade has more than 11 million clients and $1 trillion in assets. They average 500,000 trades a day, which makes them quite the big dog in the investment business.

How does it work?

Account opening

Essentials Portfolio – Investors need a minimum of $500 to open a TD Ameritrade account if they opt for direct deposits of at least $500 a month, otherwise, the minimum is $5,000. Like most robo-advisors, you’ll encounter a questionnaire that asks about your risk tolerance and timeline to create your portfolio. The Essentials Portfolio has 5 portfolio options for you to choose from.

Selective Portfolio – Investors need at least $25,000 to open a TD Ameritrade Selective Portfolio. The onboarding process is a bit more complex, but you can do it online or call 1-866-551-6917.

Deposit and withdrawal

Like most brokerages, you link your ‘funding’ account to your TD Ameritrade brokerage account, whether Essentials or Selective. You may set up direct deposit or transfer and contribute regularly to your brokerage account (recommended if you want the lower initial deposit requirement) or make manual deposits.

Withdrawals work in the same manner. You can request withdrawal to your linked account. If you have the cash in your portfolio, TD Ameritrade transfers it quickly. If they must settle a portion of your portfolio to meet your request, it can take up to a week to receive funds.

Interface

The interface is user-friendly, giving investors 24/7 access to their accounts. You can log in to change your goals or timelines at any time. Being able to track your investments, see your progress, and ask questions is helpful for any investor whether they use the Essential or Selective portfolio.

Trading options

TD Ameritrade offers the largest selection of account options including:

- Individual or joint taxable account

- Traditional retirement account

- Roth retirement account

- SEP IRA

- SIMPLE IRA

- Rollover IRA

- Trusts

- Solo 401(K)

- Roth Solo 401(K)

- Business accounts

What can you trade?

Essentials – The Essentials platform focuses on ETFs. Each portfolio is Morningstar built and includes approximately 8 ETFs. TD offers 5 portfolios including a socially responsible portfolio.

Selective – TD offers a handful of portfolios based on your timeline and goals. For example, the Core Portfolio consists of mutual funds and/or ETFs covering a wide span of investments. The Supplemental Income Portfolio places more emphasis on fixed income securities and fewer equities.

Costs

The Essentials Portfolio costs 0.3% of assets under management.

The Selective Portfolio costs vary based on the amount invested and the portfolio chosen but usually average around 0.55% – 0.9%.

Additional features

Cash account

You may have a cash balance, but TD Ameritrade doesn’t offer any type of cash management services with either service.

Human advisors

Essential Portfolio – You have access to a team of advisors who can answer your questions and help you make investment decisions.

Selective Portfolio – You get more professional insights with the Selective Portfolio. It’s a mix of technology and human advisor, giving you the best of both worlds. You may work with a financial consultant or make your own decisions based on the advice provided by the platform.

Customer service

TD Ameritrade offers customer service via email and live chat Monday – Friday 7:30 AM – 7:00 PM ET. Selective Portfolio investors may have access to phone customer service as well.

Research

TD Ameritrade offers robust research options powered by Morningstar as well as other third-party providers.

Education

TD Ameritrade offers a wide range of educational opportunities including webcasts, market news, and full-blown curriculum opportunities.

Video

TD Ameritrade Pros and Cons

FAQ

Is TD Ameritrade good for beginners?

Beginners should start with TD Ameritrade’s Essentials Portfolio. As the name suggests, they stick to the essentials. They don’t confuse you with a crazy number of investments or choices. With 5 portfolios to choose from and only 8 assets in each, it’s easy to get the hang of investing, while TD Ameritrade does the heavy lifting. Check out all the best robos for beginners in this post.

What are TD Ameritrade’s ETF expense ratios?

All ETFs have expense ratios. This money doesn’t go to TD Ameritrade, though. The 0.3% of assets under management or (0.5 – 0.99% for Selective) are the only fees TD Ameritrade collects. If you trade ETFs, expect to pay 0.06 – 0.07% for regular portfolios and 0.10 – 0.17% for socially responsible portfolios.

How often does TD Ameritrade rebalance accounts?

All TD Ameritrade accounts are rebalanced annually, but they also rebalance on an as-needed basis. If you make deposits or withdrawals, for example, they’ll need to rebalance. They also rebalance when the market takes a turn (for better or worse).

Is onboarding difficult?

TD Ameritrade makes onboarding easy for both Essential and Selective portfolios. After answering the questions, they recommend a portfolio. You are free to go through the various options, though, choosing the one you think is right for you. It’s usually best to stick with TD’s choice, though.

How much money can tax-loss harvesting save?

TD Ameritrade offers free tax-loss harvesting, which is a huge benefit. They say they can save investors up to $3,000 in tax liability by using this practice when you sell off an asset with high capital gains.

How many socially responsible portfolios does TD Ameritrade have?

TD Ameritrade has an impressive 5 portfolios to choose from if you are socially-minded. You can choose the portfolio that aligns with your beliefs so your investments and beliefs align.

How are Selective Portfolio investment fees calculated?

Unlike the Essentials Portfolio, the Selective Portfolio’s management fees depend on the amount invested and chosen portfolio. Investors know the fees before choosing an investment.

How does TD Ameritrade make money?

TD Ameritrade makes money on the fees they charge for each portfolio. They don’t charge commissions for the trades, and any fees you pay for ETF or mutual fund management goes to the fund manager, not TD Ameritrade.

Alternatives

TD Ameritrade vs Interactive Brokers

You may also trade options, futures, forex, and metals, though. IB offers 4,300 no-load fee mutual funds, but their platform is a bit harder to navigate compared to TD Ameritrade. IB charges a flat fee, versus a percentage of assets under management.

TD Ameritrade vs Webull

If you’re into technical research and want to know the ins and outs of each investment, Webull is your platform. Webull offers extensive research and educational opportunities and offers margin trading and after-hours trading.

TD Ameritrade vs Etoro

TD Ameritrade vs RobinHood

It is a basic platform, which is great for beginners. Since you don’t need an account minimum, anyone can start investing, getting a feel for how it works even with a minimal deposit.

Current Promotions

Account minimum of only $500 when setting up recurring deposits (essential portfolios)

Worth It or a Scam?

TD Ameritrade is as legitimate as they come. It’s a household name and with its two robo-advisor offerings, there is something for everyone.

Whether you’re a beginner and want a simple portfolio with 8 or fewer assets that are easy to manage or an experienced investor looking for a more robust experience, possibly managing your investments on your own, there’s something for you.

Summary

If you’re looking for a reputable robo-advisor with simple options and yet robust educational and research opportunities, TD Ameritrade is a great option.

You’ll get the best of all worlds, low fees, exceptional investments, and the guidance you desire whether complete hand-holding or a bit of DIY with guidance.

Robo Chooser

Use the following Quiz and find out which robo advisor is best for you.

Michael is a senior writer at The Robo Investor. He earned his master’s at the Craig Newmark School of Journalism at CUNY, and is currently taking CFP courses at the University of Scranton. He has been an avid finance enthusiast ever since he started investing at the age of 23. Meet the Team