Attention!

For those interested in long-term investments, I now wholeheartedly recommend Bitcoin as the primary option to consider.

However, it’s essential to educate yourself about this digital asset before diving in, as it can take time to fully grasp its intricacies and potential.

A fantastic starting point is the book “The Bitcoin Standard” (Amazon), which provides an in-depth look at the history, principles, and technology behind Bitcoin.

Once you’re ready to invest, most major exchanges offer similar fees and services, so choose one that best suits your needs. Personally, I use Crypto.com.

It’s crucial to transfer your Bitcoin to a secure wallet once you’ve made your purchase, as leaving it on an exchange can pose risks.

To truly make the most of your investment in Bitcoin, take the time to study and understand its workings. Your financial journey will benefit from a well-informed approach.

I wish you the best in your endeavors.

Sincerely

Michael J. Peterson

.

With the rise of effective and affordable algorithms for robo-advisors, some of the services are adapting a new approach in hopes to distinguish themselves from their competition:

Smart Beta Portfolios.

But what exactly are they and, more importantly, what’s the difference between robos that employ this strategy as opposed to the ones that are not?

In this article, we’ll discuss that and also the benefits and risks of the Smart Beta strategy. Betterment will serve as our example.

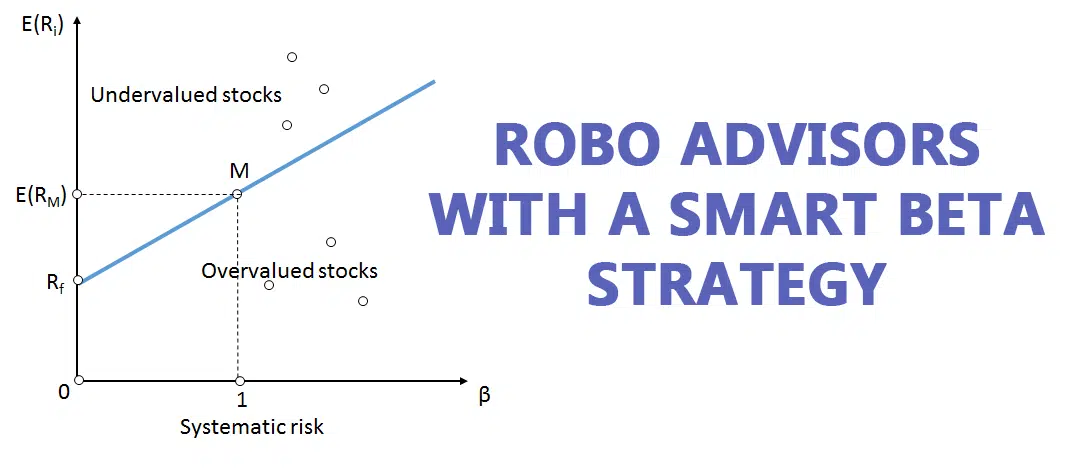

Understanding Beta

Let’s break it down first.

“Beta” simply refers to a stock’s sensitivity in the stock market. If a stock’s beta is high, that means it moves more than other stocks. However, a high beta does not determine the performance of a stock, only its amount of movement / volatility.

If a stock falls drastically below others, its movement is greater, thus raising its beta. Likewise, if a stock outperforms others on the market, its beta rises as well.

Think about it, stocks with a higher beta (movement) carry greater risks but they may also have greater returns. By understanding a stock’s sensitivity, you can build a portfolio based on your tolerance for risk.

Understanding Smart Beta

Going Beyond Traditional Strategies

Other traditional passive strategies gauge a stock’s performance by a benchmark index. What’s a benchmark index? This is a standard that helps you determine how well your stock is performing compared to the overall trend.

So what does this have to do with Smart Beta strategies?

Smart Beta strategies use both active and passive strategies to build a diverse portfolio. Using passive strategies benefits long-term investors who are willing to buy and hold stocks for a potentially high return, while active strategies take advantage of fluctuations in the market to buy and sell at the right time.

Smart Beta strategies go beyond traditional strategies and look at specific factors in a stock to outperform the standard (benchmark) index.

For example, Smart Beta strategies look at various factors for performance such as:

- Momentum

- Quality

- Size

- Value

- Volatility

What does this mean for you? This means your portfolio is based on factors that demonstrate good performance while reducing risk for your investments. If you are looking for a more detailed explanation check out this excellent video by Tim Bennett from MoneyWeek.

Which robos employ a smart beta strategy?

In this article we are mostly focusing on Betterment’s Goldman Sachs Smart Beta strategy however keep in mind that the following services are also great alternatives when it comes to investing with said strategy:

- Betterment

- Wealthfront

- SoFi Invest

- Charles Schwab

- Personal Capital

- Vanguard

- Interactive Advisors

- Fidelity Go

- Wealthsimple

- E*Trade Core Portfolios

- Titan Invest

Smart Beta Portfolios at Betterment

To meet the needs of clients today, Betterment adopted the Smart Beta portfolio used by Goldman Sachs, a method that uses investing strategies that are passive and active.

With their help, you’ll invest in high quality stocks that show strong momentum with lower risks.

Betterment’s approach to Smart Beta focuses on these four factors:

1. Good Value

How does Betterment Goldman Sachs determine value? They look for those companies with a positive net income and have a lower price. The Betterment Smart Beta strategy gives you an “in” to companies with the potential for high growth that other investors might overlook.

2. High Quality

Smart Beta looks for companies with stronger fundamental factors such as stable returns and consistent earnings as well as a potential for growth.

3. Low Volatility

Slow and steady wins the race. I hope it doesn’t surprise you but stocks with steady growth often have better long term performance than volatile stocks over time.

4. Strong Momentum

Smart Beta searches for investments have a higher momentum for growth. As a client, this means your investments will increase in value as they grow.

How Does Investing in a Smart Beta Portfolio Benefit You?

Remember those four factors we just talked about?

- Good value

- High quality

- Low volatility

- Strong momentum

Betterment Smart Beta combines these factors to maximize your potential for earning better returns when compared to alternative portfolio options.

Alternative options, such as a market weight portfolio, rely on each stock’s total capitalization. A stock’s market capitalization (market cap) is the total value of its shares.

Stocks with a higher market cap are weighted more than those with a lower cap. This means a small amount of highly valuable stocks – stocks with higher market caps – represent a large percentage of an index’s value.

What does this mean? Market weight portfolios are not as diversified and look at dollar value rather than a stock’s potential and performance.

On the other hand, Smart Beta portfolios do not simply rely on a stock’s market weight. They apply the four factors to diversify and balance a portfolio. Smart Beta portfolios implementing these four factors demonstrate improved returns on a typical index-fund market weight portfolio.

Obviously, returns are not guaranteed, but companies exhibiting these four characteristics have proven to beat the market averages.

As if that’s not enough, this Smart Beta portfolio is easily customizable. You can invest in increments of 1% for any stock. These fractional shares give you great flexibility. Based on the level of risk that you can tolerate, you can invest more or less in specific stocks.

Should You Sign Up for Betterment? Read this Betterment Review to Find Out.

Difference between Smart Beta Portfolios and Betterment’s Other Portfolios

This Smart Beta portfolio is only one option that the platform provides. Betterment offers a total of four different investment strategies.

What are the four strategies?

1. Goal-Based Investing

You create an investment goal that you have in mind. This may be saving for a new car, house or retirement. Based on your goal, algorithms used by robo-advisors suggest portfolios for you.

The more information the robo-advisor has, the better it can help you toward your goal. You answer questions about your investment goals, how long you plan to invest, and how high your tolerance for risk is. These types of portfolios are mostly passive and uses typical index funds.

2. Socially-Responsible Investing

Do you believe strongly about something? The environment, social justice, animal cruelty? This strategy is for ethically-conscious investors. Based on your priorities, an SRI portfolio helps you pick the right investments for you. The Smart Beta portfolio will potentially include SRI options, but it does not actively search for these investment opportunities.

3. Income Portfolios for BlackRock Target

Are you a conservative investor looking for cash flow options? This investment strategy is for you. These types of income portfolios are also bond portfolios and allow customization.

4. Smart Beta Portfolios from Goldman Sachs

Betterment’s Smart Beta more actively manages your stock investments. Designed to give you diverse investments with optimal customization and potential growth, this Smart Beta portfolio may be the choice for you.

| In case you’re wondering, there is assistance available to you from financial advisors no matter which investment choice you make.

And it gets even better! As a Betterment investor, you have access to the company’s various cash management benefits like a high yield savings account. |

Where Does Smart Beta from Goldman Sachs Stand With the Competition?

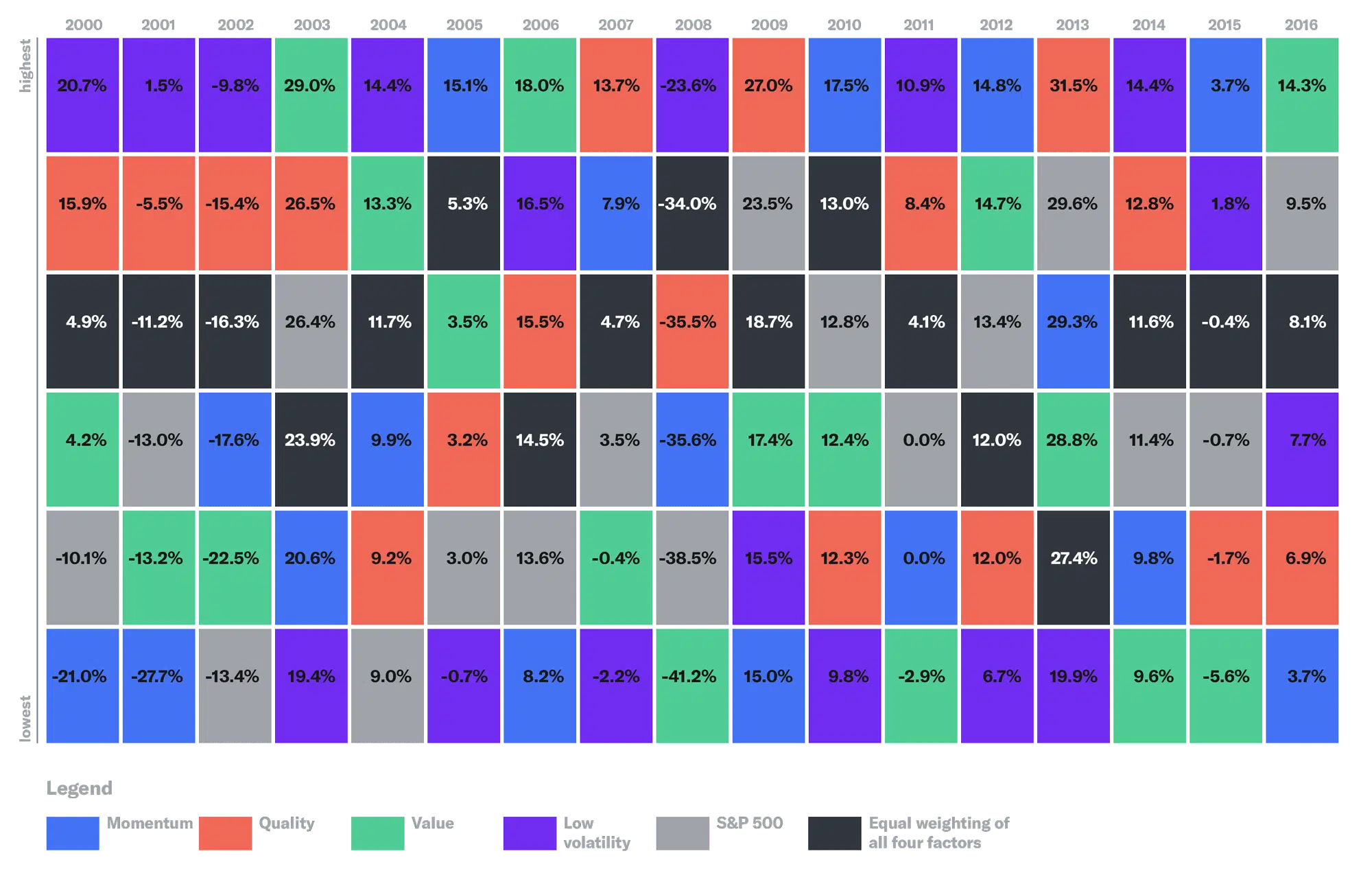

The following chart illustrates the Smart Beta’s performance vs. the S&P 500 market weighted index.

Here’s the takeaway:

- Individual factors rank high and low, but when all four are combined they perform consistently well.

- Combined factors beat the returns from the market weighted index of the S&P 500 the majority of the time

- The combined factors are more stable. Individual factors vary greatly in performance from year to year. S&P 500 diverges more into lower performance as well.

Now, while Betterment’s combined factors have never taken the top spot in any year, they perform consistently well and often beat the returns of the market weighted index from S&P 500.

If you’re looking to use this Smart Beta, this is good news for you. The combined factors offer better security and overall performance against traditional market weighted indices.

What Risks Should You Consider?

While Smart Beta has a history of performing well against the competition, there is no absolute guarantee. There will always be risk in any type of investment.

Be certain about your goals and risk tolerance before investing.

Strategies that attempt to outperform the market can give great gains but also suffer severe losses. Smart Beta is designed for those who are willing to ride out the bad times. If you are more conservative or just looking for short-term investments, you may want to consider one of Betterment’s other portfolio options. Goal-based or BlackRock may suit your needs better.

Pros and Cons

We’ve covered a lot of material. You’ve learned about the benefits and risks of Betterment’s Smart Beta from Goldman Sachs. Now, let’s do a quick review.

FAQ

Still have questions? This Q/A section will help you decide if a Smart Beta portfolio is right for you.

Should I consider investing with a Smart Beta portfolio if I want low-risk investments?

Probably not. Smart Beta portfolios are designed for long-term investors who are willing to take risks and ride out low times. BlackRock Target investing may be a better choice.

I’m looking for a short-term investment option. Is Smart Beta the way to go?

No. Factors used in Smart Beta are based on long-term potential growth. A goal-based portfolio is better for short-term investors.

I’m looking for a long-term option and am willing to take higher risks. Is Smart Beta a good choice for me?

Yes. Smart Beta is designed for long-term investors who have a better tolerance for risk. Betterment’s strategy attempts to maximize growth, despite drops in value. If you are willing to ride out the hard times, Smart Beta is a potentially high-return investment strategy.

Should You Invest with Betterment’s Smart Beta Portfolio?

I say give it a shot. This is just my opinion so take it for what it’s worth but the overall potential benefits outrank the negatives. In addition to all this, you have always have the option change your plan. As an investor with Betterment, you don’t have to stick with one method. You can distribute part of your investments towards a Smart Beta strategy and the rest in a portfolio of market index funds.

Michael is a senior writer at The Robo Investor. He earned his master’s at the Craig Newmark School of Journalism at CUNY, and is currently taking CFP courses at the University of Scranton. He has been an avid finance enthusiast ever since he started investing at the age of 23. Meet the Team