If you’re looking to invest in socially responsible companies, look no further than OpenInvest.

Not only do they have the largest selection of socially responsible assets, but they are also the most transparent company in terms of fees and terms.

OpenInvest is more than a trading platform, it’s a chance for investors to cast their support in the form of investments in the companies that they believe in and do right by the universe.

With OpenInvest, there’s no guessing – you know exactly what you get. Check out our review on this great platform to see if it suits your investment needs.

What is OpenInvest?

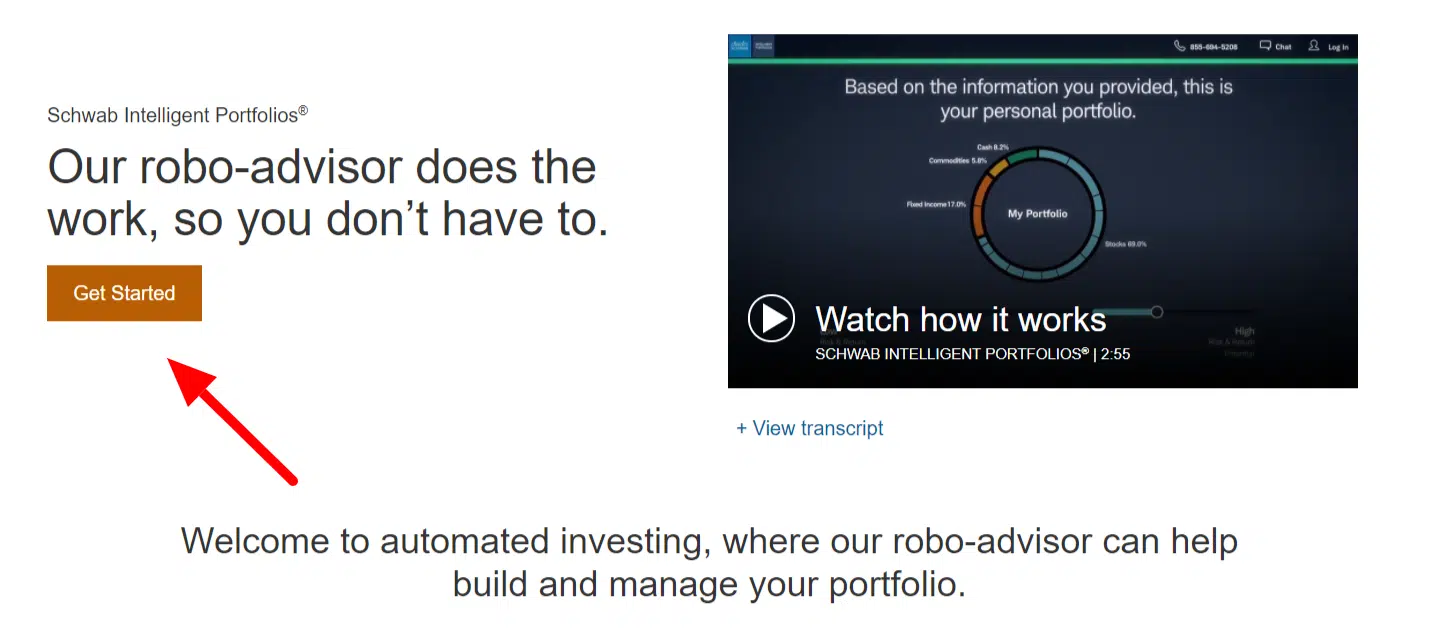

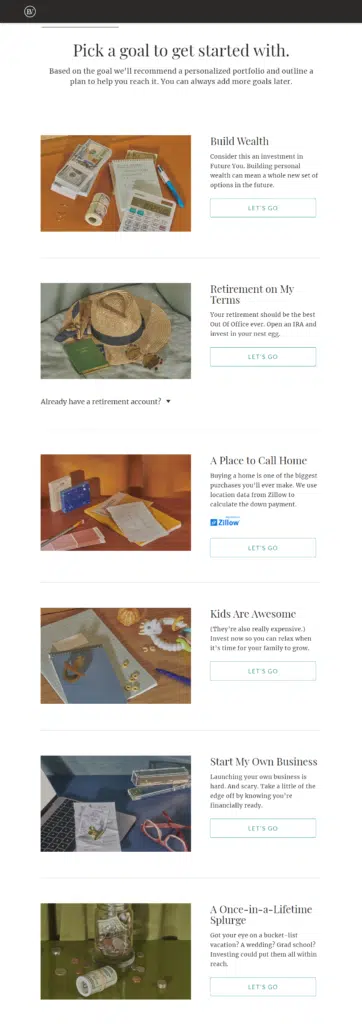

OpenInvest is a robo-advisor, much like its competitors, such as Ellevest and Wealthfront. What it does different, though, is its socially responsible investing. Whereas other robo-advisors have a few socially responsible investment options, OpenInvest focuses on them, providing mostly socially-conscious investments.

You won’t find the standard survey or questionnaire when you open your account. You are in charge of the assets you put in your portfolio based on your ethical preferences.

You choose the causes that interest you the most – whether it’s fossil fuel producers, LGBTQ rights, or women-centric companies – honestly the sky’s the limit. Think of your cause and there’s likely assets that align with it in OpenInvest.

Don’t worry, these unique benefits don’t mean you must sacrifice other important robo-advisor benefits including low fees, tax-loss harvesting, and a variety of account options. With OpenInvest, you can have it all – a socially-responsible, affordable, and balanced portfolio.

How does it work?

Account opening

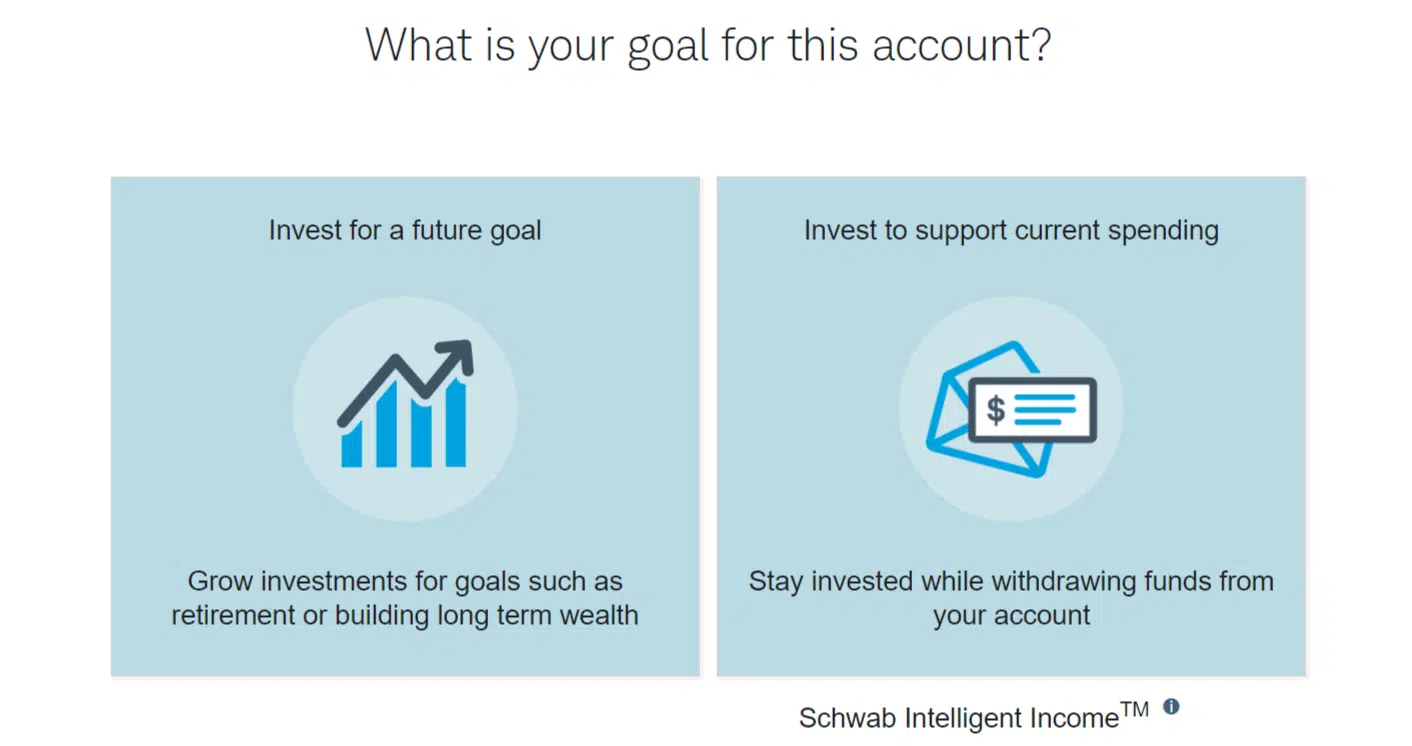

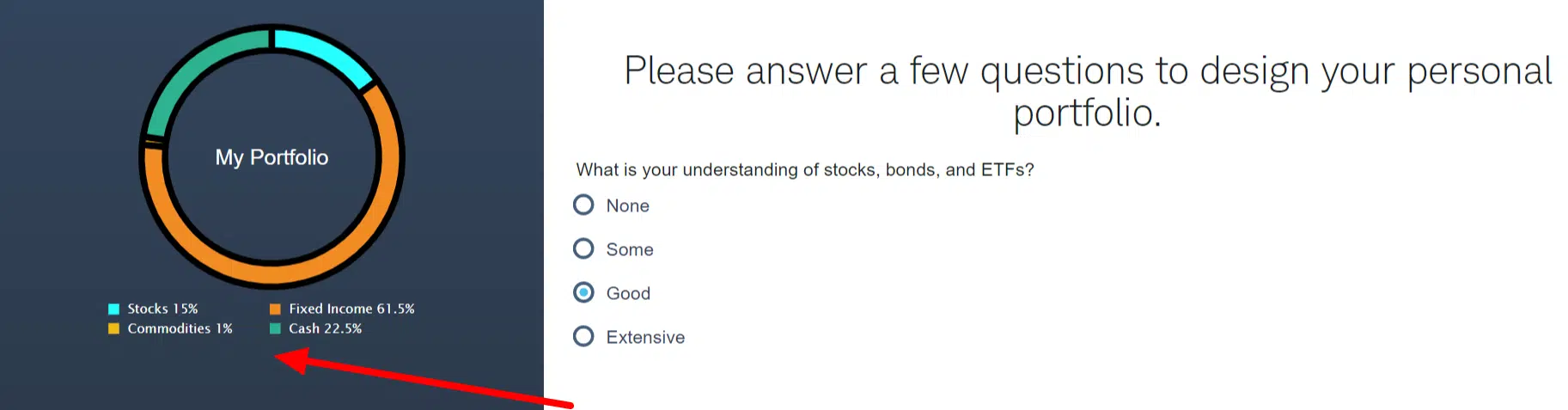

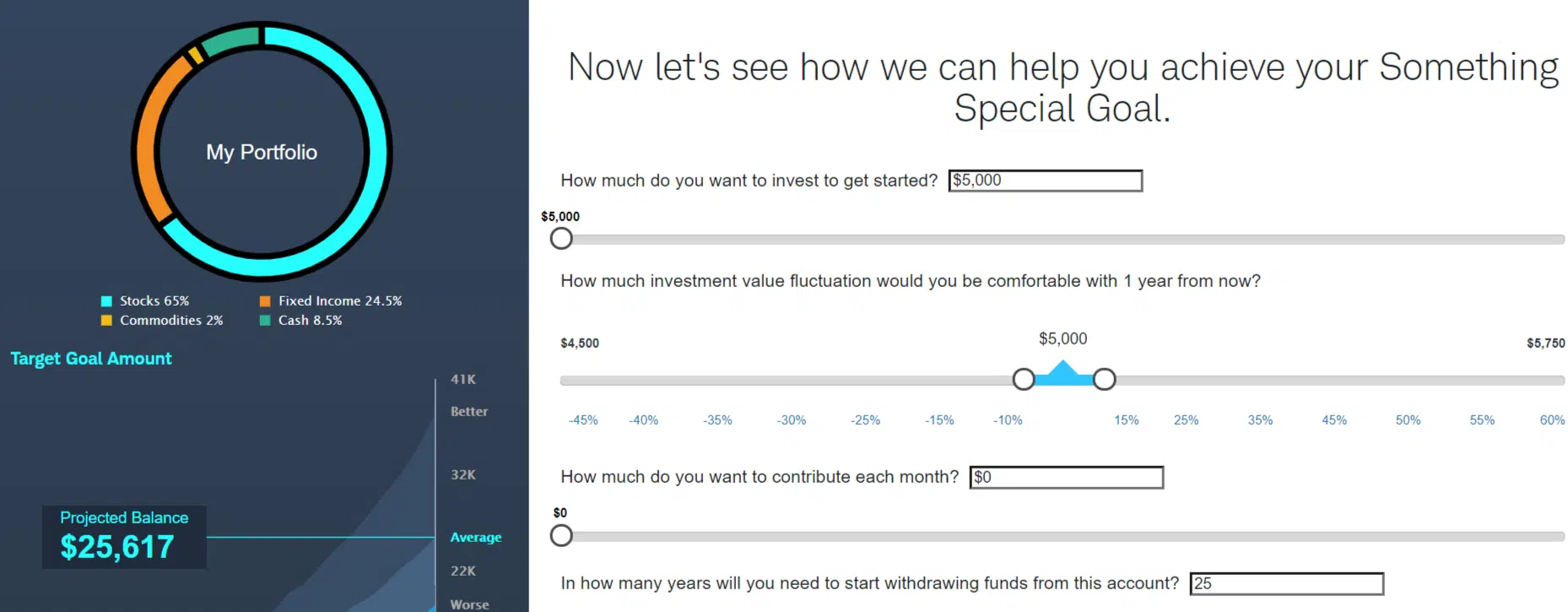

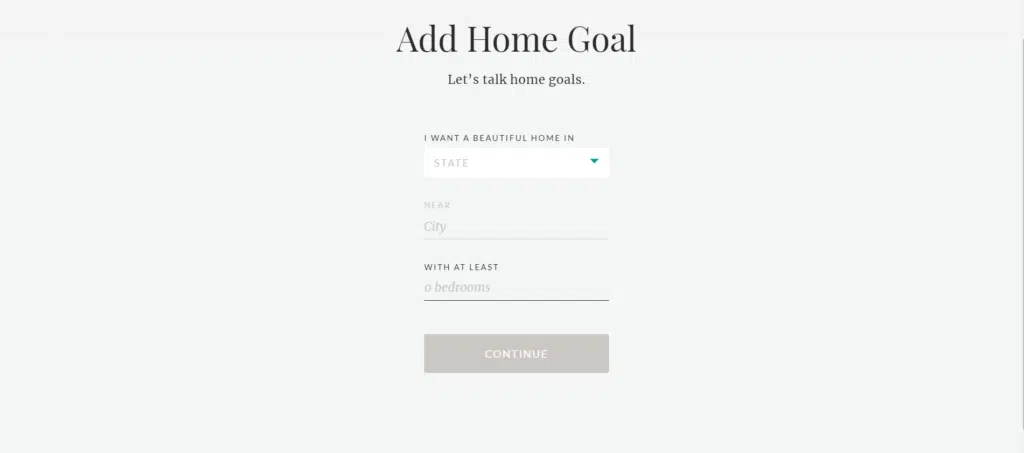

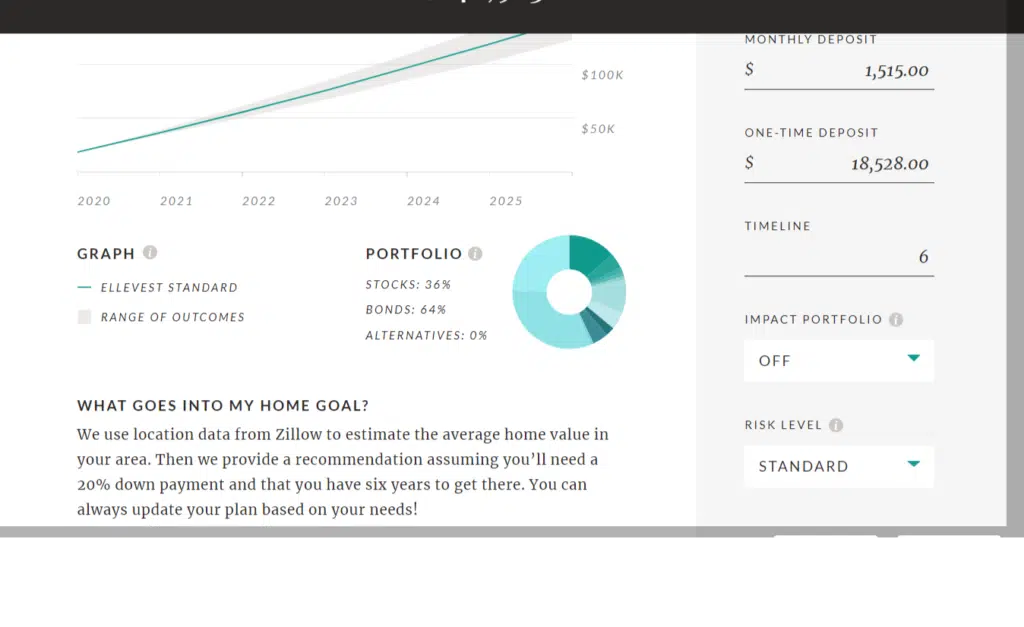

Investors need a minimum $3,000 to open an account. When you sign up, you’ll see different questions than you’re used to. These questions are based on your beliefs rather than your goals and risk tolerance.

They do ask about your investment objective, which can include your goals, but most people using this platform for its socially responsible investing, of course they want to make money too, but the focus is on social responsibility. They will create a sample portfolio with recommendations that you may use or customize as you see fit.

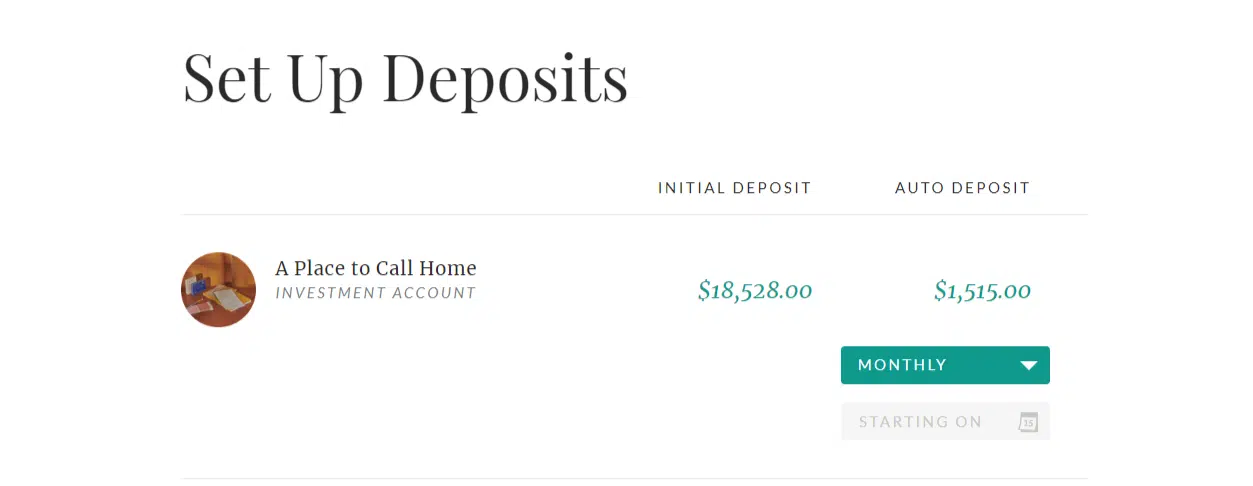

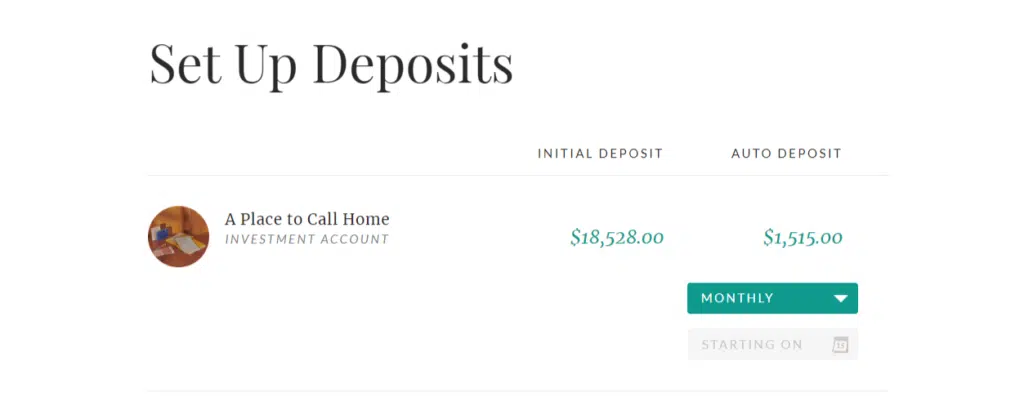

Deposit and withdrawal

OpenInvest makes it easy to set up automatic deposits. Just email the team at support@openinvest.com to tell them the amount you want to deposit and how often. Once you set it up, you don’t have to do anything else. The deposits are done for you. Of course, you can also make manual deposits if you’re more comfortable with it.

Withdrawals are 100% manual through OpenInvest as well. Email the support team and tell them how much you want withdrawn and where you want it sent – usually you send it to your linked bank account.

Interface

The interface is simple, but user-friendly. OpenInvest has a mobile app along with its web-based platform where you can see the status of your investments at any given time. You may also take part in shareholder resolutions by casting your vote in the app.

This gives you a say in the companies you invest your money in – helping the world with more than your money, but your ideas too.

Trading options

OpenInvest offers a wide selection of account types including:

- Taxable account – This is a standard investment account. You pay taxes on your capital gains, but OpenInvest offers tax-loss harvesting to minimize your tax liabilities. They allow individual, joint, and custodial taxable accounts.

- Traditional IRA – Get ready for retirement with a socially responsible IRA. You contribute your funds pre-tax, but pay taxes on the contributions and earnings when you withdraw them, at your taxable rate during retirement.

- Roth IRA – If you’d prefer to contribute after-tax dollars and let your contributions and earnings grow tax-free, consider the Roth IRA. You pay no taxes when you withdraw your funds.

What can you trade?

Another factor that differentiates OpenInvest from other robo-advisors is the asset selection. Yes, you can invest in ETFs with low-cost management fees like many other robo-advisors, but they also offer 60+ individual stocks to choose from as well as bonds (Vanguard Total Bond Market) and a Green Bond Fund.

**Please note, if you choose the Green Bond Fund there’s an additional 0.22% of assets under management fee on top of the regular 0.50% annual fee.

Costs

OpenInvest is one of the most affordable socially responsible investment firms available today. While their annual management fee seems higher than most robo-advisors, it encompasses almost every fee you could encounter.

Investors investing in standard investments pay 0.50% of assets under management. Any investor choosing the Green Bond Fund pays an addition 0.22%.

Here’s where OpenInvest truly shines (aside from their socially responsible investing) – there are no ETF expense ratios. Most robo-advisors have a management fee plus the expense ratios. Everything is wrapped into the 0.50% fee.

OpenInvest also reimburses investors whose IRA charges them to transfer their account over to OpenInvest.

Additional features

- Passive investment strategy – OpenInvest uses a passive investment strategy. They aren’t in it to beat the market. Instead, their portfolios ‘hold’ the market by diversifying and minimizing fees.

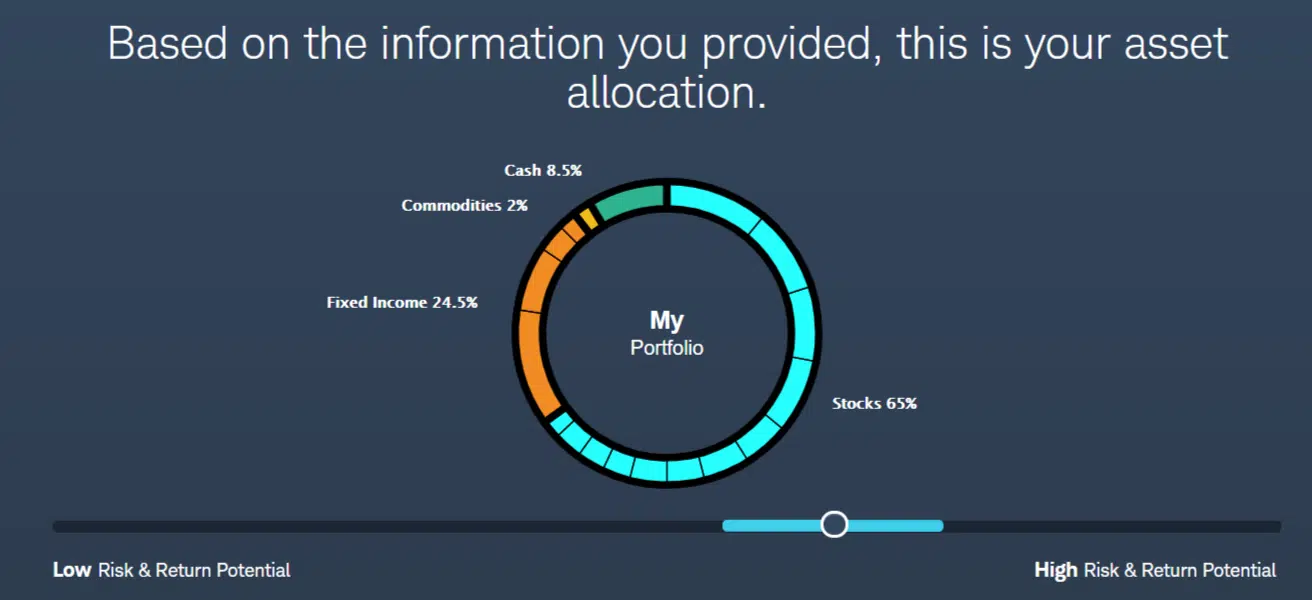

- Diversification – Most portfolios have no less than 60 stocks that coincide with your chosen theme, along with bonds to offset the riskiness of the stocks if you have a more conservative risk tolerance.

- Tax-loss harvesting – All equities accounts automatically have tax-loss harvesting benefits to help minimize your tax liabilities.

- 401K rollover services – You can rollover your 401K into an OpenInvest IRA of the same type (traditional or Roth). This makes it easy to keep your retirement investments on track while having choices with your investments.

- Customer service – OpenInvest has customer service hours via phone and email during the hours of 9 AM – 5 PM PT.

- Research – OpenInvest doesn’t offer 3rd party research, but they do have a blog updated with the latest newsworthy information.

Video

OpenInvest Pros and Cons

FAQ

What is the mission of OpenInvest?

OpenInvest has a mission to help everyday investors invest in the things they believe in. They don’t focus on beating the market, but rather mimicking it by investing in large cap stocks that are socially conscious and align with each investor’s beliefs.

Does OpenInvest diversify your portfolio?

Yes, OpenInvest starts with stock or equity assets that mimic your beliefs and investment goals. They balance it out with bonds according to your risk profile, including the Green Bond fund if applicable. OpenInvest is very transparent with their offerings, fees, and how the process works.

How is OpenInvest different than other robo-advisors?

The premise is the same among most robo-advisors, but OpenInvest has one difference – the socially responsible investments. They don’t stick you in a predefined portfolio based on the answers in your survey. Instead, they listen to your beliefs and what you desire and they help you invest in the assets that mean the most to you rather than using a one-size-fits-all approach.

Does OpenInvest manage IRAs?

Yes, you can rollover an existing IRA or 401K or open a new account with OpenInvest. The options include a traditional IRA, Roth IRA, and SEP IRA for self-employed individuals. However, if you’re opening an SEP IRA or rolling over an existing 401K, it’s best to contact customer service first.

Can I connect my OpenInvest account with other tracking software, such as Mint?

Yes, OpenInvest makes it easy to track your account via any software you use. You’ll first have to set up the allowance through Apex Clearing, as that is the custodian that holds onto your investments.

Can I invest in equities not listed in OpenInvest’s offerings?

OpenInvest has an ‘open’ environment where they accept requests for certain investments, but they may not be able to grant all of them. Contact customer support if you want to add an investment to your portfolio. For the most part, they offer a large list of large-cap investments plus the bond funds to diversify the portfolio.

What are Green Bonds?

Green bonds are tax exempt bonds. The funds are used by the government to develop undervalued areas that are run down or underdeveloped, but that usually have low pollution levels. Bonds are loans to help build up the areas and enhance the environmental friendliness of the area.

How does OpenInvest make money?

Like any robo-advisor that charges an annual management fee, OpenInvest makes money on the money you invest. They withdraw the fee on a monthly basis (dividing the annual fee by 12 months).

Alternatives

OpenInvest vs TD Ameritrade

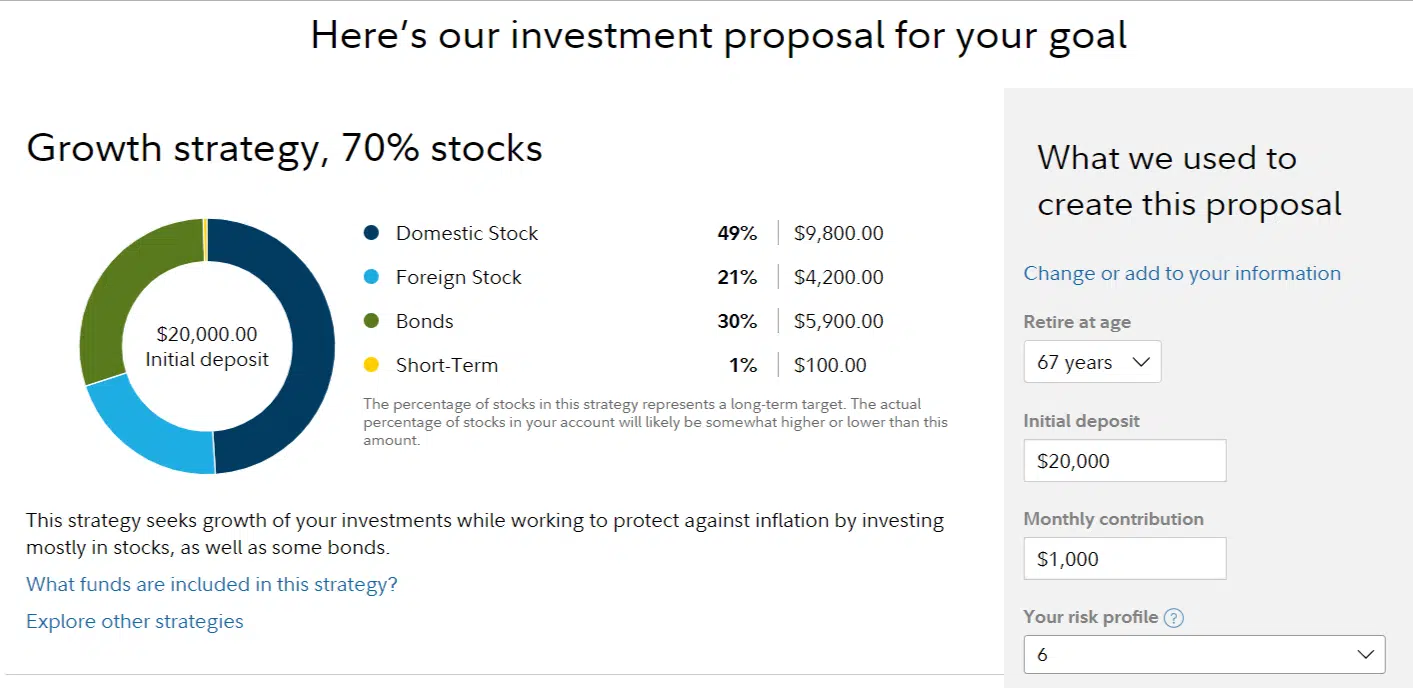

The account management fee is 0.3% and the ETF expense ratios are 0.10% – 0.17%. TD Ameritrade offers tax-loss harvesting and they have what they call ‘Socially Aware Portfolios’ which investors may choose instead of the standard portfolio options.

TD Ameritrade Essential Portfolios is good for investors that already have a TD Ameritrade account and have an interest in socially responsible portfolios.

Current Promotions

There are currently no promotions.

Worth It or a Scam?

OpenInvest is certainly worth it for investors that want a say in where their money goes. If you’d rather not invest in companies whose beliefs don’t align with yours, you won’t. They’ll let you choose and keep you informed throughout the process. Because of their involvement in choosing socially responsible investments, they engage with investors more than other low-cost robo-advisors, ensuring that your portfolio always aligns with your beliefs, even as companies evolve.

Summary

If you’re looking for an ‘activist’ type portfolio, you’ll find it at OpenInvest. Nowhere else do you get the say or level of engagement you get at OpenInvest.

While you should be careful not to make rash investment decisions based on changes a company makes, there are times that you may want to pull out of a company because of their change in ethics or involvement in their socially responsible decisions.

If you believe in socially-responsible investments, this is the platform for you. Most other platforms make socially-responsible investments an after-thought, but OpenInvest makes it the priority.

Michael is a senior writer at The Robo Investor. He earned his master’s at the Craig Newmark School of Journalism at CUNY, and is currently taking CFP courses at the University of Scranton. He has been an avid finance enthusiast ever since he started investing at the age of 23. Meet the Team

Betterment is a robo-advisor that’s great for beginners.

Betterment is a robo-advisor that’s great for beginners.  Do you want the best of both worlds between an automated advisor and a human advisor?

Do you want the best of both worlds between an automated advisor and a human advisor?

If your primary focus is mutual funds and ETFs,

If your primary focus is mutual funds and ETFs,

Like FutureAdvisors,

Like FutureAdvisors,

If you want free investing,

If you want free investing,

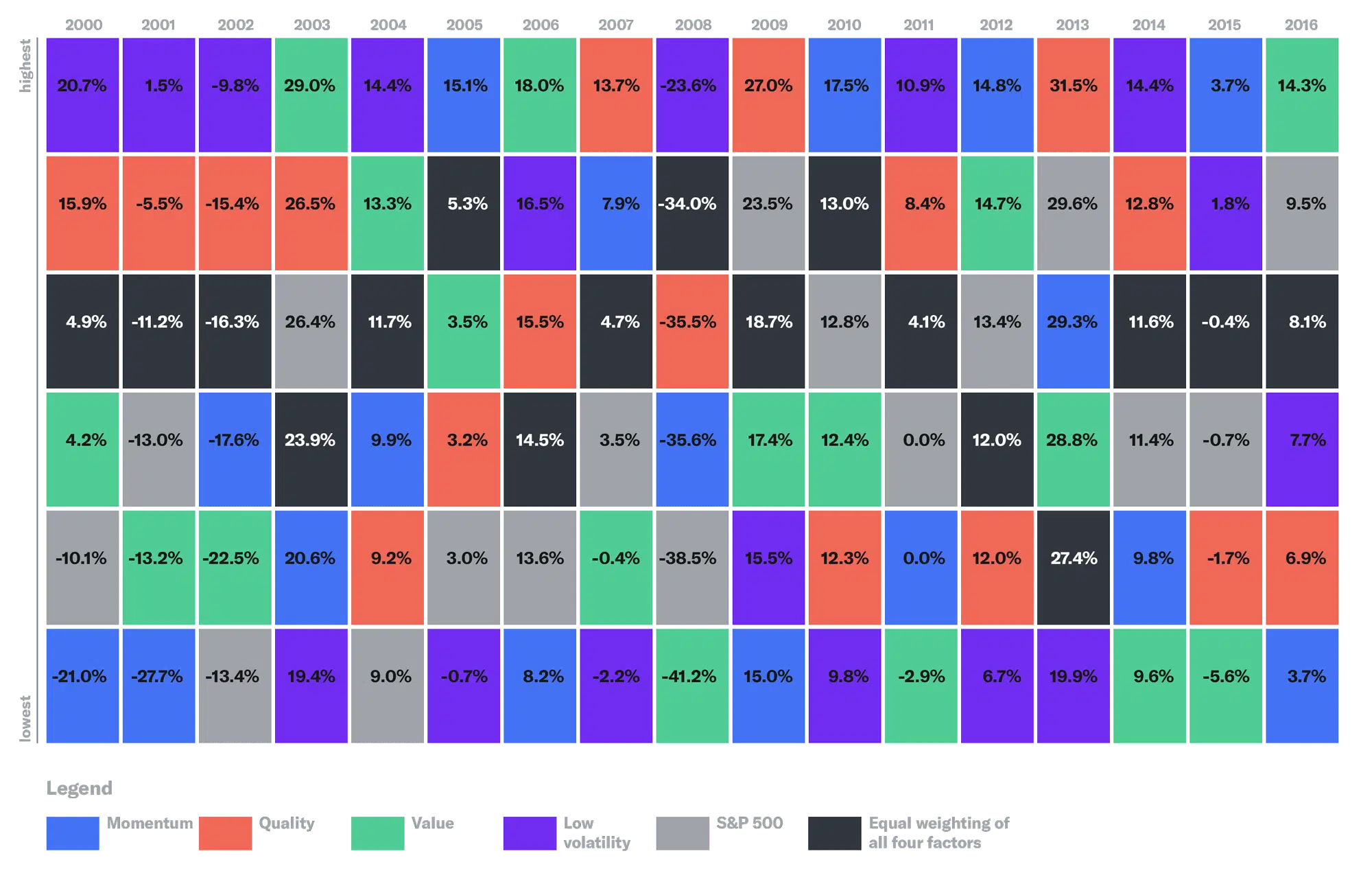

Gray represents the S&P 500’s performance over the last sixteen years. Black shows the performance of Betterment’s four factors combined. The other colors demonstrate the individual performance of each factor.

Gray represents the S&P 500’s performance over the last sixteen years. Black shows the performance of Betterment’s four factors combined. The other colors demonstrate the individual performance of each factor.